Popular on s4story

- Libraries for Kids International Announces 2026 Board of Directors - 169

- Tawanna Chamberlain Launches New Book, Outsized Ambition: The Blueprint for Going Beyond! - 127

- Phillip E Walker's EntryLevelActing.com Actor Employment Advice E-Book Road Map Launches on MLK Day

- For Valentine's Day: Treat yourself (and maybe even your sweetheart) to some Not Exactly Love Poems

- New Middle Grade Novel A New Way to Know Releases February 2, 2026

- New Anthology Release by Dark Moon Books: HORROR LIBRARY, VOLUME 9

- 2026 Grateful American Book Prize Call for Submissions

- Author Gate Strengthens Traditional Publishing Through Investment in Writers and Editors

- Q3 2025 Arizona Technology Industry Impact Report Highlights Shifting Job Demand, Semiconductor Momentum and Workforce Investment

- Independent Comic Publisher Launches Community-Driven Anthology in South Carolina

Similar on s4story

- Aleen Inc. (C S E: ALEN.U) Advances Digital Wellness Vision with Streamlined Platform Navigation and Long-Term Growth Strategy

- RimbaMindaAI Officially Launches Version 3.0 Following Strategic Breakthrough in Malaysian Market Analysis

- Fed Rate Pause & Dow 50k: Irfan Zuyrel on Liquidity Shifts, Crypto Volatility, and the ASEAN Opportunity

- Finland's Health Authority Launches '2-4-2' Gambling Risk Limits Ahead of Expected Advertising Boom

- Digital Efficiency Consulting Group (DECG) Officially Launches

- Work 365 Delivers Purpose-Built Revenue Operations for Microsoft Cloud for US Government

- Meridianvale Unveils QarvioFin Public Beta: The First 'Glass Box' AI Operating System for Autonomous Finance

- Postmortem Pathology Expands to Phoenix: Bringing Families Answers During Their Most Difficult Moments

- Blasting Off with Space Sector Companies: Artemis II Manned Moon Mission is Set to Launch: Could $ASTI be on the Same Rocket Ride as $ASTS & $LUNR?

- HBMHCW Expande Infraestructura de Cumplimiento para Argentina mientras América Latina Supera $1.5 Billones en Volumen Cripto

$1 Million Share Repurchase Signals Confidence as Off The Hook YS Scales a Tech-Driven Platform in the $57 Billion U.S. Marine Market

S For Story/10681784

Off The Hook YS Inc. (N Y S E: OTH) $OTH is Projected to Reach $140 to $145 Million in 2026 and is Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry

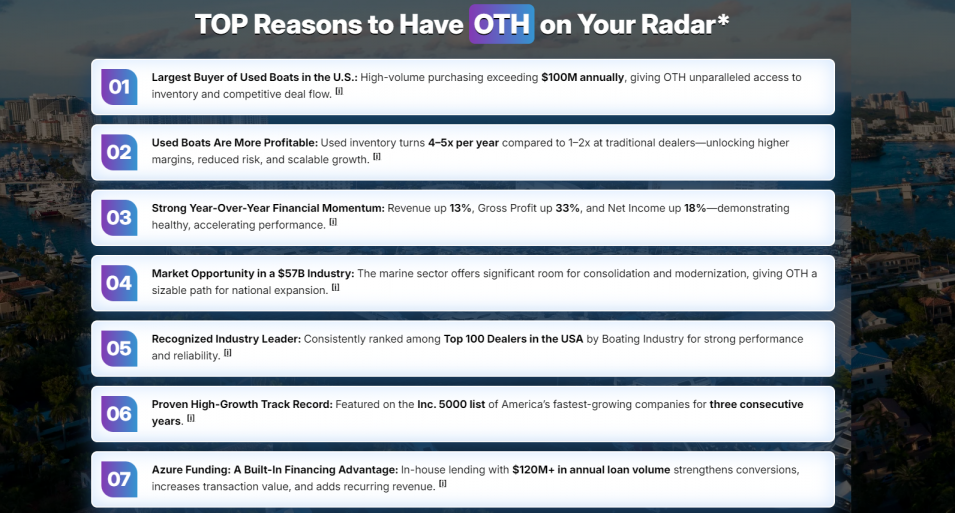

WILMINGTON, N.C. - s4story -- Off The Hook YS Inc. (N Y S E: OTH) is emerging as one of the most compelling under-the-radar growth stories in the U.S. marine industry. Fresh off its 2025 IPO, the Company has authorized a $1 million share repurchase program, launched a high-end luxury yacht brokerage with over $100 million in listings, and delivered record revenues with accelerating unit volume—all while operating in a fragmented, $57 billion domestic marine market ripe for consolidation.

Management's recent actions suggest a clear message to investors: the current market valuation does not reflect the Company's intrinsic value or its forward growth trajectory.

A Scaled Leader in Pre-Owned Boats—Powered by Technology

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, Off The Hook YS has become one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually.

Unlike traditional brokerages, OTH operates a technology-enabled, asset-intelligent platform, leveraging proprietary AI-assisted valuation tools and a data-driven sales engine to bring speed, transparency, and liquidity to marine transactions. This platform advantage allows OTH to efficiently price inventory, accelerate deal velocity, and manage risk across market cycles.

The Company supports this digital infrastructure with a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales—creating a vertically integrated model few competitors can replicate.

Share Repurchase Program Highlights Undervaluation

On January 8, OTH announced authorization to repurchase up to $1.0 million of its common stock, to be funded through cash on hand and future cash flows.

More on S For Story

"Today's stock price and market capitalization do not, in management's view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead," said Brian John, Chief Executive Officer.

The repurchase program underscores management's confidence in the Company's strategy and signals a disciplined capital allocation approach—particularly notable given OTH's early stage as a newly public company with significant growth initiatives underway.

Autograph Yacht Group: A High-Margin Luxury Growth Engine

One of OTH's most intriguing developments is the October 2025 launch of Autograph Yacht Group, its internally created luxury yacht brokerage division.

In just its first quarter of operations, Autograph has:

Autograph operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, placing it squarely in one of the most active luxury boating corridors in the U.S.

What differentiates Autograph is its ability to accept trade-ins, something traditional luxury brokerages typically cannot do. This capability is powered by OTH's proprietary AI platform and wholesale trading operation—creating a structural competitive advantage that improves pricing accuracy, client experience, and transaction velocity.

Financial Momentum and Record Operating Metrics

OTH delivered strong operating performance throughout 2025, highlighted by accelerating unit growth and record revenues.

Nine-Month 2025 Highlights

Q3 2025 Highlights

Importantly, management issued 2026 revenue guidance of $140 million to $145 million, implying a meaningful step-change in scale as Autograph Yacht Group ramps and platform efficiencies compound.

More on S For Story

Structural Tailwinds: Tax Incentives and Industry Growth

The macro backdrop further strengthens OTH's investment thesis.

The "One Big Beautiful Bill Act", signed into law in July 2025, reinstated 100% bonus depreciation for qualifying boats and yachts purchased and placed into service by January 19, 2026. This incentive creates a powerful, time-bound catalyst for business buyers—especially when combined with OTH's national inventory and aggressive pricing.

Meanwhile, the broader marine ecosystem continues to expand:

OTH's scale, data advantage, and national footprint position it well to capture share in both transactional and recurring marine services over time.

Independent Research Coverage Highlights Margin Inflection Opportunity

Adding further credibility, Digital BD Deep Research issued a detailed investor report titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market" (December 8, 2025)

The Bottom Line

Off The Hook YS is no longer just a high-volume boat dealer—it is evolving into a technology-driven marine marketplace with expanding margins, a growing luxury segment, and multiple near-term catalysts. The newly authorized share repurchase program, accelerating luxury brokerage traction, and strong 2026 revenue outlook suggest a company entering its next phase of value creation.

For investors seeking exposure to a differentiated platform within a large, fragmented industry, OTH presents a story that is increasingly difficult to ignore.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Website: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Management's recent actions suggest a clear message to investors: the current market valuation does not reflect the Company's intrinsic value or its forward growth trajectory.

A Scaled Leader in Pre-Owned Boats—Powered by Technology

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, Off The Hook YS has become one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually.

Unlike traditional brokerages, OTH operates a technology-enabled, asset-intelligent platform, leveraging proprietary AI-assisted valuation tools and a data-driven sales engine to bring speed, transparency, and liquidity to marine transactions. This platform advantage allows OTH to efficiently price inventory, accelerate deal velocity, and manage risk across market cycles.

The Company supports this digital infrastructure with a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales—creating a vertically integrated model few competitors can replicate.

Share Repurchase Program Highlights Undervaluation

On January 8, OTH announced authorization to repurchase up to $1.0 million of its common stock, to be funded through cash on hand and future cash flows.

More on S For Story

- Iranian-Born Engineer Mohsen Bahmani Introduces Propeller-Less Propulsion for Urban Air Mobility

- Aleen Inc. (C S E: ALEN.U) Advances Digital Wellness Vision with Streamlined Platform Navigation and Long-Term Growth Strategy

- RimbaMindaAI Officially Launches Version 3.0 Following Strategic Breakthrough in Malaysian Market Analysis

- Fed Rate Pause & Dow 50k: Irfan Zuyrel on Liquidity Shifts, Crypto Volatility, and the ASEAN Opportunity

- 20/20 Institute Launches Updated Vision Correction Procedures Page for Denver & Colorado Springs

"Today's stock price and market capitalization do not, in management's view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead," said Brian John, Chief Executive Officer.

The repurchase program underscores management's confidence in the Company's strategy and signals a disciplined capital allocation approach—particularly notable given OTH's early stage as a newly public company with significant growth initiatives underway.

Autograph Yacht Group: A High-Margin Luxury Growth Engine

One of OTH's most intriguing developments is the October 2025 launch of Autograph Yacht Group, its internally created luxury yacht brokerage division.

In just its first quarter of operations, Autograph has:

- Secured over $100 million in active listings

- Closed 22 transactions totaling $35 million

- Built strong momentum in yachts ranging from $500,000 to $20 million+

Autograph operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, placing it squarely in one of the most active luxury boating corridors in the U.S.

What differentiates Autograph is its ability to accept trade-ins, something traditional luxury brokerages typically cannot do. This capability is powered by OTH's proprietary AI platform and wholesale trading operation—creating a structural competitive advantage that improves pricing accuracy, client experience, and transaction velocity.

Financial Momentum and Record Operating Metrics

OTH delivered strong operating performance throughout 2025, highlighted by accelerating unit growth and record revenues.

Nine-Month 2025 Highlights

- Record revenue of $82.6 million, up 19.3% year over year

- 310 boats sold, up 24.4%

- Net income of $0.8 million

- Gross profit of $8.4 million, up $1.5 million year over year

Q3 2025 Highlights

- Revenue of $24.0 million

- 112 boats sold, up 51% year over year

- Second-highest quarterly unit sales in Company history

- Adjusted EBITDA of $0.5 million

Importantly, management issued 2026 revenue guidance of $140 million to $145 million, implying a meaningful step-change in scale as Autograph Yacht Group ramps and platform efficiencies compound.

More on S For Story

- OneVizion Announces Next Phase of Growth as Brad Kitchens Joins Board of Directors

- New Children's Picture Book "Diwa of Mount Luntian" Focuses on Calm, Culture, and Connection for Today's Families

- Actor, Spokesperson Rio Rocket Featured in "Switch to AT&T" Campaign Showing How Customers Can BYOD and Keep Their Number

- The World's No.1 Superstar® Brings Disco Fever Back With New Global Single and Video "Disco Dancing"

- Boston Industrial Solutions' Natron® 512N Series UV LED Ink Achieves BPA Certification, Advancing Safe and Sustainable Digital Printing

Structural Tailwinds: Tax Incentives and Industry Growth

The macro backdrop further strengthens OTH's investment thesis.

The "One Big Beautiful Bill Act", signed into law in July 2025, reinstated 100% bonus depreciation for qualifying boats and yachts purchased and placed into service by January 19, 2026. This incentive creates a powerful, time-bound catalyst for business buyers—especially when combined with OTH's national inventory and aggressive pricing.

Meanwhile, the broader marine ecosystem continues to expand:

- The U.S. marine industry is valued at $57 billion

- The U.S. ship repair and maintenance services market is projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033, at a 7.52% CAGR

OTH's scale, data advantage, and national footprint position it well to capture share in both transactional and recurring marine services over time.

Independent Research Coverage Highlights Margin Inflection Opportunity

Adding further credibility, Digital BD Deep Research issued a detailed investor report titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market" (December 8, 2025)

The Bottom Line

Off The Hook YS is no longer just a high-volume boat dealer—it is evolving into a technology-driven marine marketplace with expanding margins, a growing luxury segment, and multiple near-term catalysts. The newly authorized share repurchase program, accelerating luxury brokerage traction, and strong 2026 revenue outlook suggest a company entering its next phase of value creation.

For investors seeking exposure to a differentiated platform within a large, fragmented industry, OTH presents a story that is increasingly difficult to ignore.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Website: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on S For Story

- Authoress S.E. Gregg Offers Gold-Signed Copies in 2026"

- "They Thought It Was Impossible to Expose Them — This Is Exactly How It Was Done"

- Love Against Oblivion: Uri J. Nachimson's KADOSH

- Raconteur Press Announces Promotions, Increased Focus on Boys Adventure Books

- Parkway Prosthodontics Achieves Breakthrough Full-Arch Reconstruction Case

- Postmortem Pathology Expands to Phoenix: Bringing Families Answers During Their Most Difficult Moments

- Blasting Off with Space Sector Companies: Artemis II Manned Moon Mission is Set to Launch: Could $ASTI be on the Same Rocket Ride as $ASTS & $LUNR?

- redrosethorns Announces Second Book Acquisition of a Romantasy Novelette by Christin Marie

- Costa Oil Named Primary Sponsor of Carson Ware for the United Rentals 300 at Daytona International Speedway

- HBMHCW Expande Infraestructura de Cumplimiento para Argentina mientras América Latina Supera $1.5 Billones en Volumen Cripto

- Norisia Launches AI Formulated Luxury Multivitamin to Transform Daily Wellness in the UK

- California Book Publishers Turns Author Visions into Professional Publications

- Jacob Emrani's Annual "Supper Bowl" Expected To Donate Thousands Of Meals

- NASA / Glenn Research Center Collaboration to Help Meet Rising Demand for Space Energy Beaming Tech / CIGS PV Modules from Ascent Solar: NAS DAQ: ASTI

- Author Tracy Wise Reimagines the Regency Romance with a Love Story for Modern Sensibilities

- When Interpretation Becomes Conversation: Rethinking Engagement in the Museum Age

- History Matters: Book Recommendations for February

- Half of Finnish Online Gambling Expenditure Now Flows to Offshore Instant Casinos as License Applications Open March 1, 2026

- RTC Communications Completes Next Level Connect Fiber Expansion Bringing Multi-Gig Broadband to West Boggs Community

- EPP Pricing Platform announces leadership transition to support long-term growth and continuity