Popular on s4story

- Super League (N A S D A Q: SLE) Enters Breakout Phase: New Partnerships, Zero Debt & $20 Million Growth Capital Position Company for 2026 Acceleration - 159

- Christy Sports donates $56K in new gear to SOS Outreach to help kids hit the slopes - 153

- Writing a Memoir About His Hometown of Quincy Mass. Turned Into a Search for His Missing Father - 140

- Russellville Huntington Learning Center Expands Access to Literacy Support; Approved Provider Under Arkansas Department of Education - 139

- Entering 2026 with Expanding Footprint, Strong Industry Tailwinds, and Anticipated Q3 Results: Off The Hook YS Inc. (N Y S E American: OTH) - 137

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026 - 114

- New Book "Downsize With Dignity" Helps Missouri Families Navigate Senior Moves - 107

- T-TECH Partners with Japan USA Precision Tools for 2026 US Market Development of the New T-TECH 5-Axis QUICK MILL™

- UK Financial Ltd Announces A Special Board Meeting Today At 4PM: Orders MCAT Lock on CATEX, Adopts ERC-3643 Standard, & Cancels $0.20 MCOIN for $1

- Private Keys Are a Single Point of Failure: Security Advisor Gideon Cohen Warns MPC Technology Is Now the Only Defense for Institutional Custody

Similar on s4story

- Appliance EMT Expands Professional Appliance Repair Services to Hartford, Connecticut

- OneSolution® Expands to Orlando with New Altamonte Springs Implant Center

- Robert DeMaio, Phinge Founder & CEO, Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- The 22% Tax Reality: Finland's New Gambling Law Creates a "Fiscal Trap" for Grey Market Casino Players

- Phinge Founder & CEO Robert DeMaio Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- UK Financial Ltd Executes Compliance Tasks Ahead Of First-Ever ERC-3643 Exchange-Traded Token, SMCAT & Sets Date For Online Investor Governance Vote

- eJoule Inc Participates in Silicon Dragon CES 2026

- HBZBZL Unveils "Intelligent Ecosystem" Strategy: Integrating AI Analytics with Web3 Incubation

- Kaltra Launches Next-Gen MCHEdesign With Full Integration Into MCHEselect — Instant Simulation & Seamless Microchannel Coil Workflow

- Trump's Executive Order Rescheduling Cannabis: Accelerating M&A in a Multibillion-Dollar Industry

$73.6M Pipeline, $10M Crypto Play & Legal Firepower: Why Investors Are Watching Cycurion (N A S D A Q: CYCU) Like a Hawk

S For Story/10674953

$CYCU Initiates Legal Battle Against Naked Shorting and Defamation Aligns with Explosive Growth in AI-Driven Cybersecurity Contracts and a Shareholder Dividend via $1M Equity Alliance with IQSTEL

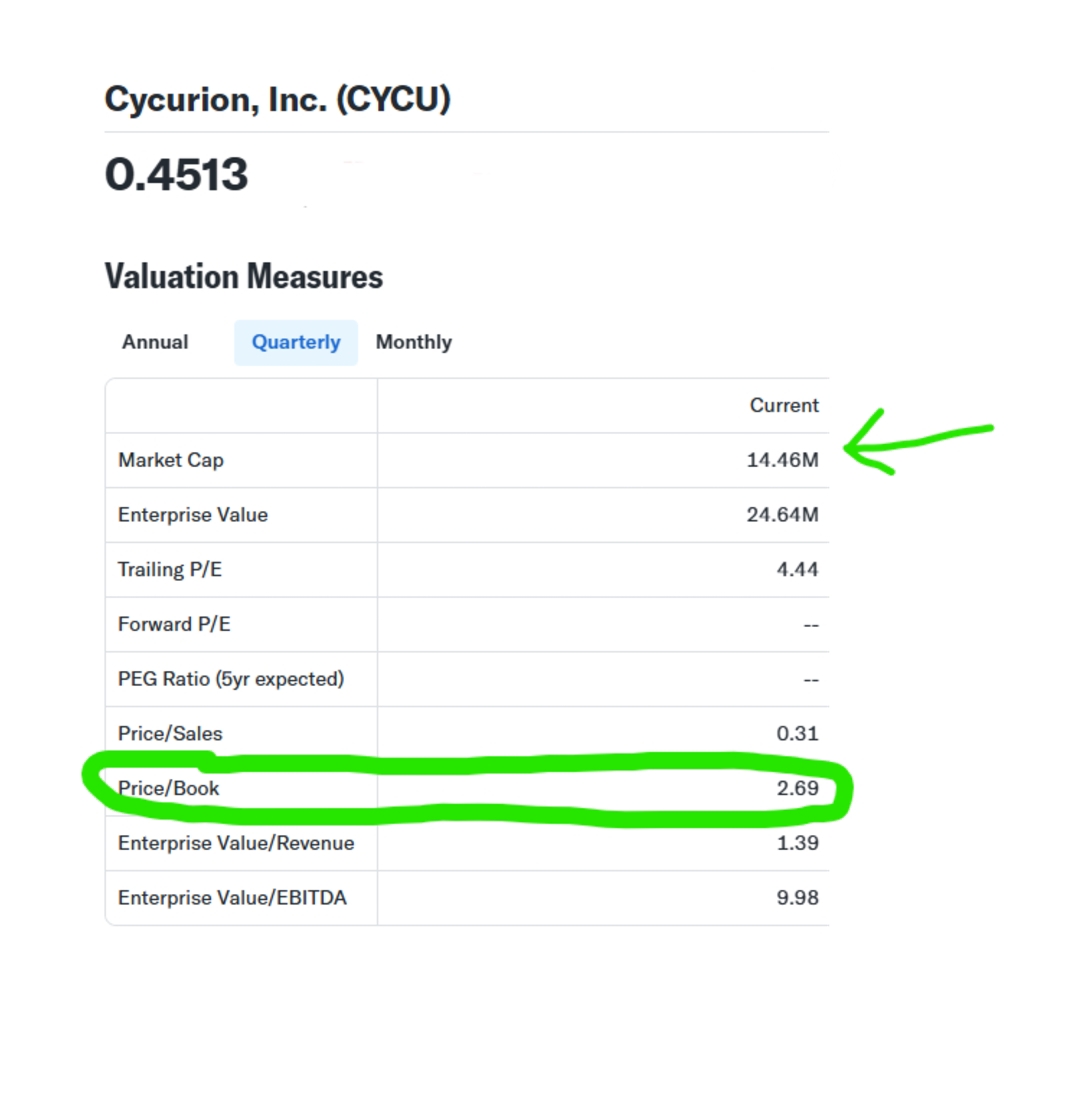

MCLEAN, Va. - s4story -- While Wall Street often favors flashy headlines, it's substance and structure that create lasting value — and Cycurion, Inc. (N A S D A Q: CYCU) has both in spades.

From defending the nation's most critical digital assets to launching a $10M crypto treasury and uncovering evidence of naked short selling, CYCU is building a compelling narrative of resilience, expansion, and shareholder alignment — backed by a $73.6 million contract pipeline and cutting-edge, AI-infused cybersecurity technology.

And with a mutual equity exchange with IQSTEL (N A S D A Q: IQST) — where half of the received shares will be distributed as a dividend to shareholders — CYCU is delivering a rare combo of deep tech innovation and investor-focused value creation.

Blockbuster Setup: AI-Powered Growth Meets Market Integrity Crusade

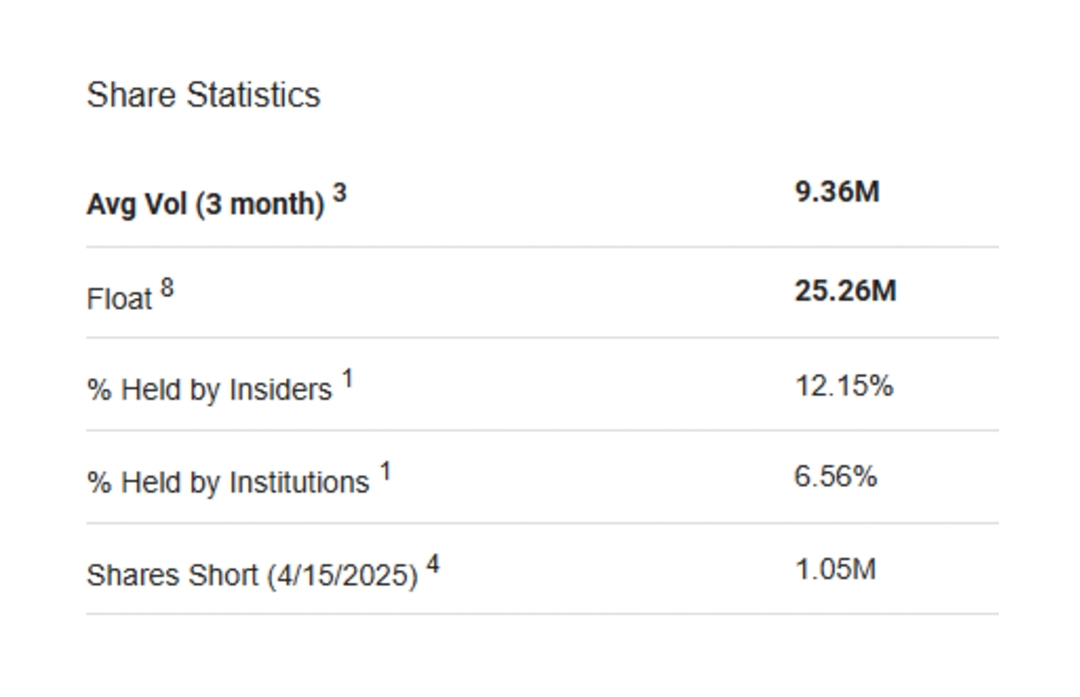

On October 14th, Cycurion publicly declared war on illegal market manipulation, announcing it had uncovered a coordinated campaign of online defamation and potential naked short selling targeting its stock.

Leveraging its own proprietary AI cybersecurity platform, Cycurion's cyber ops team traced digital footprints across X (Twitter), Reddit, Yahoo, and other platforms. The evidence collected has led the company to engage legal counsel, with plans to:

✅ File a John Doe lawsuit to unmask bad actors

✅ Pursue civil and possibly criminal action

✅ Collaborate with platforms and regulatory authorities to hold offenders accountable

Why it matters: Naked short selling and false narratives can suppress a stock's valuation regardless of company fundamentals. By taking aggressive legal action, CYCU is not only protecting its brand — it's defending its shareholders.

$73.6M in Contracts + $4.6M in New Deals = Undervalued Stock?

While market manipulation might shake weaker companies, Cycurion continues to execute:

More on S For Story

📌 $4.6 million in new contracts announced in September 2025, adding to the

📌 $69 million backlog, bringing the total to $73.6 million in AI-powered cybersecurity deals.

These contracts span 15+ engagements across industries and government sectors, many with terms from 1 to 10 years. Major clients include:

This isn't hype. This is real revenue from real institutions with some of the highest cybersecurity standards on Earth.

$1M Stock Exchange with IQST — Shareholders to Receive a Dividend in Publicly Traded Stock

On September 3rd, Cycurion and N A S D A Q-listed partner IQSTEL (N A S D A Q: IQST) completed a $1 million mutual stock exchange, solidifying a strategic alliance around AI-powered cybersecurity.

Here's the kicker for investors:

✅ Up to 50% of the exchanged shares will be distributed as a stock dividend to shareholders of both companies.

✅ This creates dual equity exposure — CYCU shareholders will also become stakeholders in IQST, and vice versa.

Investor takeaway: This isn't dilution. It's dividend-based value creation — a bold move that rewards loyalty and enhances visibility across two emerging tech platforms.

Cycurion Crypto: $10 Million Treasury Allocation into Ethereum and Bitcoin

In July, CYCU unveiled a bold, forward-thinking strategy: the formation of Cycurion Crypto, a wholly owned subsidiary with a mission to:

📌 Allocate $10 million (pending board approval) from its $60M equity line

📌 Build a Bitcoin and Ethereum treasury

📌 Diversify holdings while entering the expanding blockchain economy

This digital asset strategy not only enhances CYCU's balance sheet but also signals a commitment to being a cybersecurity leader in the Web3 future.

AI-Powered Platform: ARx is Leading the Charge in Cyber Defense

Cycurion's flagship technology, ARx, is a multi-layered SaaS cybersecurity platform that inspects every digital request and response — blocking malicious traffic before it even reaches critical infrastructure.

More on S For Story

Unlike traditional solutions, ARx is hardware-free, cloud-independent, and fully private — features that make it especially attractive to top-tier clients and government agencies with strict security protocols.

Real-time threat detection. Proprietary tech. Scalable deployment. This is cybersecurity built for today's threats and tomorrow's wars.

Q2 Financial Results: A Turnaround in Progress

Yes, Q2 2025 saw revenue decline due to government contract delays — but CYCU is clearly focused on converting its $73.6 million backlog, and positioning itself for massive forward revenue realization.

Q2 2025 Highlights:

This temporary softness is being met with bold strategic plays: AI scaling, equity partnerships, crypto investments, and aggressive shareholder protection.

Why CYCU May Be Deeply Undervalued — and Worth Watching Closely

Between:

✅ A $73.6M contract pipeline

✅ Legal action against market manipulation

✅ A shareholder dividend in public equity

✅ Entry into crypto treasury with Ethereum and Bitcoin

✅ Government and Fortune 100 clientele

✅ And partnerships with growth platforms like IQSTEL...

Cycurion appears significantly undervalued relative to peers.

The combination of hard assets, recurring revenue potential, and proactive leadership is rare in the small-cap space — particularly in a hot sector like cybersecurity projected to hit $878B by 2034.

Bottom Line: CYCU Is Building More Than Cybersecurity — It's Building Trust

In an era where investor confidence is fragile and digital threats are rising, CYCU is showing up with transparency, technology, and tenacity.

Whether it's going head-to-head with market manipulators, securing billion-dollar clients, or rewarding shareholders through dividends and crypto upside, Cycurion is playing a bold, long-term game — and investors are starting to notice.

📌 Ticker: CYCU

📌 Exchange: N A S D A Q

📌 Sector: Cybersecurity, AI, Crypto

📌 Website: www.cycurion.com

📌 Investor Contact: info@cycurion.com | 888-341-6680

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

From defending the nation's most critical digital assets to launching a $10M crypto treasury and uncovering evidence of naked short selling, CYCU is building a compelling narrative of resilience, expansion, and shareholder alignment — backed by a $73.6 million contract pipeline and cutting-edge, AI-infused cybersecurity technology.

And with a mutual equity exchange with IQSTEL (N A S D A Q: IQST) — where half of the received shares will be distributed as a dividend to shareholders — CYCU is delivering a rare combo of deep tech innovation and investor-focused value creation.

Blockbuster Setup: AI-Powered Growth Meets Market Integrity Crusade

On October 14th, Cycurion publicly declared war on illegal market manipulation, announcing it had uncovered a coordinated campaign of online defamation and potential naked short selling targeting its stock.

Leveraging its own proprietary AI cybersecurity platform, Cycurion's cyber ops team traced digital footprints across X (Twitter), Reddit, Yahoo, and other platforms. The evidence collected has led the company to engage legal counsel, with plans to:

✅ File a John Doe lawsuit to unmask bad actors

✅ Pursue civil and possibly criminal action

✅ Collaborate with platforms and regulatory authorities to hold offenders accountable

Why it matters: Naked short selling and false narratives can suppress a stock's valuation regardless of company fundamentals. By taking aggressive legal action, CYCU is not only protecting its brand — it's defending its shareholders.

$73.6M in Contracts + $4.6M in New Deals = Undervalued Stock?

While market manipulation might shake weaker companies, Cycurion continues to execute:

More on S For Story

- OneSolution® Expands to Orlando with New Altamonte Springs Implant Center

- Beyond the Book: Clarity & Purpose with Award-Winning Author Renee Daniel Flagler

- Indian Peaks Veterinary Hospital Launches Updated Dental Services Page for Boulder Pet Owners

- Dugan Air Donates $10,000 to Indian Creek Schools

- Robert DeMaio, Phinge Founder & CEO, Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

📌 $4.6 million in new contracts announced in September 2025, adding to the

📌 $69 million backlog, bringing the total to $73.6 million in AI-powered cybersecurity deals.

These contracts span 15+ engagements across industries and government sectors, many with terms from 1 to 10 years. Major clients include:

- U.S. Department of Defense

- Defense Intelligence Agency

- Department of Homeland Security

- U.S. Navy

- Multiple Fortune 100 & 500 Companies

This isn't hype. This is real revenue from real institutions with some of the highest cybersecurity standards on Earth.

$1M Stock Exchange with IQST — Shareholders to Receive a Dividend in Publicly Traded Stock

On September 3rd, Cycurion and N A S D A Q-listed partner IQSTEL (N A S D A Q: IQST) completed a $1 million mutual stock exchange, solidifying a strategic alliance around AI-powered cybersecurity.

Here's the kicker for investors:

✅ Up to 50% of the exchanged shares will be distributed as a stock dividend to shareholders of both companies.

✅ This creates dual equity exposure — CYCU shareholders will also become stakeholders in IQST, and vice versa.

Investor takeaway: This isn't dilution. It's dividend-based value creation — a bold move that rewards loyalty and enhances visibility across two emerging tech platforms.

Cycurion Crypto: $10 Million Treasury Allocation into Ethereum and Bitcoin

In July, CYCU unveiled a bold, forward-thinking strategy: the formation of Cycurion Crypto, a wholly owned subsidiary with a mission to:

📌 Allocate $10 million (pending board approval) from its $60M equity line

📌 Build a Bitcoin and Ethereum treasury

📌 Diversify holdings while entering the expanding blockchain economy

This digital asset strategy not only enhances CYCU's balance sheet but also signals a commitment to being a cybersecurity leader in the Web3 future.

AI-Powered Platform: ARx is Leading the Charge in Cyber Defense

Cycurion's flagship technology, ARx, is a multi-layered SaaS cybersecurity platform that inspects every digital request and response — blocking malicious traffic before it even reaches critical infrastructure.

More on S For Story

- Higgland Studios Publishes E-Book 'Two Babies Called Twins'

- 2025: A Turning Point for Human Rights. CCHR Demands End to Coercive Psychiatry

- The 22% Tax Reality: Finland's New Gambling Law Creates a "Fiscal Trap" for Grey Market Casino Players

- Phinge Founder & CEO Robert DeMaio Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- Donna Cardellino Manager/Facilitator Signs Justin Jeansonne Country Singer-Songwriter To Exclusive Management Deal For Global Music Expansion

Unlike traditional solutions, ARx is hardware-free, cloud-independent, and fully private — features that make it especially attractive to top-tier clients and government agencies with strict security protocols.

Real-time threat detection. Proprietary tech. Scalable deployment. This is cybersecurity built for today's threats and tomorrow's wars.

Q2 Financial Results: A Turnaround in Progress

Yes, Q2 2025 saw revenue decline due to government contract delays — but CYCU is clearly focused on converting its $73.6 million backlog, and positioning itself for massive forward revenue realization.

Q2 2025 Highlights:

- Net Revenue: $3.9M

- Gross Profit: $0.2M

- Adjusted EBITDA: $(1.0)M (vs. $0.7M profit in Q2 2024)

- Debt Reduced: $3.5M converted to equity — a strategic clean-up move

This temporary softness is being met with bold strategic plays: AI scaling, equity partnerships, crypto investments, and aggressive shareholder protection.

Why CYCU May Be Deeply Undervalued — and Worth Watching Closely

Between:

✅ A $73.6M contract pipeline

✅ Legal action against market manipulation

✅ A shareholder dividend in public equity

✅ Entry into crypto treasury with Ethereum and Bitcoin

✅ Government and Fortune 100 clientele

✅ And partnerships with growth platforms like IQSTEL...

Cycurion appears significantly undervalued relative to peers.

The combination of hard assets, recurring revenue potential, and proactive leadership is rare in the small-cap space — particularly in a hot sector like cybersecurity projected to hit $878B by 2034.

Bottom Line: CYCU Is Building More Than Cybersecurity — It's Building Trust

In an era where investor confidence is fragile and digital threats are rising, CYCU is showing up with transparency, technology, and tenacity.

Whether it's going head-to-head with market manipulators, securing billion-dollar clients, or rewarding shareholders through dividends and crypto upside, Cycurion is playing a bold, long-term game — and investors are starting to notice.

📌 Ticker: CYCU

📌 Exchange: N A S D A Q

📌 Sector: Cybersecurity, AI, Crypto

📌 Website: www.cycurion.com

📌 Investor Contact: info@cycurion.com | 888-341-6680

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business

0 Comments

Latest on S For Story

- Genuine Hospitality, LLC Selected to Operate Hilton Garden Inn Birmingham SE / Liberty Park

- Kilpack's Sci-Fi Novella Pale Face Named Finalist in Literary Global Book Awards

- Documentary "Prescription for Violence: Psychiatry's Deadly Side Effects" Premieres, Exposes Link Between Psychiatric Drugs and Acts of Mass Violence

- Price Improvement on Luxurious Lāna'i Townhome with Stunning Ocean Views

- Nextvisit Co-Founder Ryan Yannelli Identifies Six Critical Factors for Behavioral Health Providers Evaluating AI Scribes in 2026

- CredHub and Real Property Management Join Forces to Empower Franchise Owners with Rental Payment Credit Reporting Solutions

- Dodd, Mead & Company Revived Under Current Trademark Ownership

- Leimert Park Announces Weeklong Kwanzaa Festival & Kwanzaa Parade Celebrating Black History, Culture, and Community

- Independent Author Launches National Registry Following $16M Federal Antitrust Complaint

- Renowned Alternative Medicine Specialist Dr. Sebi and His African Bio Mineral Balance Therapy Are the Focus of New Book

- Psychiatric Drug Damage Ignored for Decades; CCHR Demands Federal Action

- Why Millions Are Losing Sexual Sensation, And Why It's Not Age, Hormones, or Desire

- February 2026 Issue of Impact & Influence Magazine is Here. See What's Inside!

- Justin Jeansonne An Emerging Country Singer-Songwriter Music Fans Have Been Waiting For…a True Maverick

- Russellville Huntington Learning Center Expands Access to Literacy Support; Approved Provider Under Arkansas Department of Education

- Writing a Memoir About His Hometown of Quincy Mass. Turned Into a Search for His Missing Father

- UK Financial Ltd Launches U.S. Operations Following Delaware Approval

- Author Charlene Wexler Earns International Impact Book Award for We Won't Go Back

- Pinealage: the app that turns strangers into meditation companions — in crowdfunding phase

- Upland Studios Commissions Former NFL Player Dontrell Johnson as Its First Bespoke Client