Popular on s4story

- People & Stories/Gente y Cuentos Announces New Board Leadership & Corporate Partnership Initiative - 135

- Mensa identifies best board games of 2025 - 130

- Electives Appoints DraftKings' CPO Linda Aiello to Board Amid Record Quarter - 105

- Is Billboard Advertising Still Effective in 2025?

- Two exciting new fantasy & adventure books are published

- MAJOR New release of Krypto500 (ELF-HF) Sigint - COMINT software

- Mission 3A Establishes Healthcare Advisory Board with Addition of Industry Leaders Patrick Fisher, Kevin Cordell, and Dr. Greg Berlet

- "The Eyes Have It" a Short Story by Philip K. Dick Now Available on Audiobook

- Fairfield Inn by Marriott Scottsdale Old Town Opens

- New Build-to-Suit VA Medical Office Facility Coming to Highland Heights, KY

Similar on s4story

- Fairmint Introduces First Fully Onchain and Open Cap Table Infrastructure

- Aureli Construction Sets the Standard for Seamless Home Additions in Greater Boston

- ScreenPoints Puts Film Investors in the Credits—and in the Money With New FinTech Platform

- Robert Fabbio Inducted into the Austin Technology Council Hall of Fame

- Cybersecurity is Protecting Your Personal Information and Your Portfolio

- L2 Aviation Celebrates Grand Opening of New Facility at Cincinnati/Northern Kentucky International Airport (CVG)

- The Paris Court of International Arbitration Elects Dr. John J. Maalouf as its New President

- $56.7 Million Announced in Q1 2025 with Revenue Growth and Progress Toward NASDAQ Uplisting for AI Marketing Company: IQSTEL, Inc. Stock Symbol: IQSTD

- SAVVY MINING raised $500 million and launched BTC.XRP.DOGE cloud mining, increasing investors' returns by 30%

- ImagineX, in Collaboration with Qualys, Launches New mROC Services to Transform Enterprise Cyber Risk Management

StackSource Introduces Commercial Mortgage Lender Match Score

S For Story/10608231

NEW YORK - s4story -- StackSource, a pioneer in matching commercial real estate deals with the right financing options online, proudly introduces a groundbreaking upgrade to its lending platform aimed at increasing transparency into its proprietary matching algorithm. The new Match Score feature reveals key components of the algorithm so borrowers can understand and prioritize

The Match Score feature evaluates lenders across three pivotal dimensions:

Responsiveness: StackSource's platform tracks and measures lenders' responsiveness to deals submitted through its system. This metric gauges the promptness and efficiency with which lenders engage and respond to incoming opportunities.

Competitiveness on Terms: The platform assesses lenders' competitiveness on crucial financing terms such as interest rates, leverage, recourse, prepayment penalties, and other essential parameters. This metric aids borrowers in identifying lenders that can potentially offer the most favorable terms.

Sweet Spot Alignment: Understanding that each lender has a distinct niche or preference, StackSource's system evaluates how closely a specific deal aligns with a lender's preferences or sweet spot. This factor significantly enhances the probability of a successful match by identifying lenders whose criteria best fit the borrower's needs.

More on S For Story

Furthermore, the platform computes a comprehensive Match Score by combining these three dimensions. This score streamlines the decision-making process, offering borrowers a clear and concise evaluation of the suitability of a lender for their specific financing requirements.

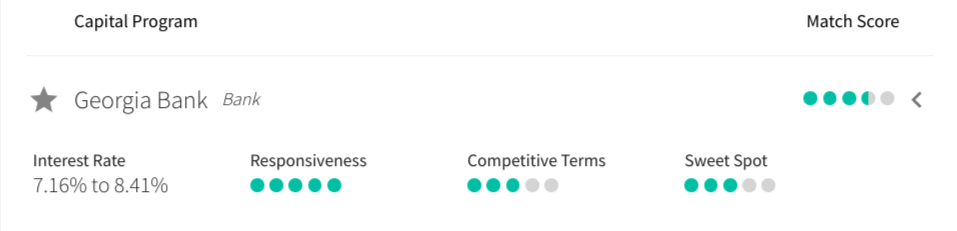

The presentation of these scores is visualized for every matched capital program through an easy-to-understand user-friendly interface. Each of the four metrics - responsiveness, competitiveness, sweet spot alignment, and the overall Match Score - is depicted graphically with a 5-dot visual representation. The dots are filled to a varying degree, providing a quick and intuitive understanding of the degree of match for each criterion.

"Traditional loan brokers are notorious for making self-interested, relationship-based decisions when it comes to placing deals with lenders, rather than opening the kimono for borrowers to understand their range of options," says Tim Milazzo, CEO and Co-founder of StackSource. "Our goal is to empower borrowers by providing them with transparent and data-driven insights, facilitating more efficient and effective financing decisions, along with the guidance and support of an expert Capital Advisor."

More on S For Story

This enhancement reinforces StackSource's commitment to leveraging technology to streamline and optimize the commercial real estate financing experience.

About StackSource

StackSource is a tech-enabled commercial real estate finance platform. The company connects investors who are developing or acquiring commercial properties with financing options including banks, insurance companies, debt funds, private equity, and other alternative capital providers through a simple, transparent online process. StackSource, ranked #777 on the Inc. 5000 list of fastest-growing private companies, is taking the best of commercial mortgage brokerage and updating it for the 21st century. Learn more at StackSource.com.

The Match Score feature evaluates lenders across three pivotal dimensions:

Responsiveness: StackSource's platform tracks and measures lenders' responsiveness to deals submitted through its system. This metric gauges the promptness and efficiency with which lenders engage and respond to incoming opportunities.

Competitiveness on Terms: The platform assesses lenders' competitiveness on crucial financing terms such as interest rates, leverage, recourse, prepayment penalties, and other essential parameters. This metric aids borrowers in identifying lenders that can potentially offer the most favorable terms.

Sweet Spot Alignment: Understanding that each lender has a distinct niche or preference, StackSource's system evaluates how closely a specific deal aligns with a lender's preferences or sweet spot. This factor significantly enhances the probability of a successful match by identifying lenders whose criteria best fit the borrower's needs.

More on S For Story

- Inspiring memoir about growing up well with good support & guidance

- Historical Fantasy 'Keeper of the Hollow' Weaves Faith, Mystery, and Mountain Magic

- Fairmint Introduces First Fully Onchain and Open Cap Table Infrastructure

- Vortex Brands Begins Gold Purchases Under New Joint Venture with Dubai-Based Partner

- I Turned Mom into a Popsicle! Hits the Shelves

Furthermore, the platform computes a comprehensive Match Score by combining these three dimensions. This score streamlines the decision-making process, offering borrowers a clear and concise evaluation of the suitability of a lender for their specific financing requirements.

The presentation of these scores is visualized for every matched capital program through an easy-to-understand user-friendly interface. Each of the four metrics - responsiveness, competitiveness, sweet spot alignment, and the overall Match Score - is depicted graphically with a 5-dot visual representation. The dots are filled to a varying degree, providing a quick and intuitive understanding of the degree of match for each criterion.

"Traditional loan brokers are notorious for making self-interested, relationship-based decisions when it comes to placing deals with lenders, rather than opening the kimono for borrowers to understand their range of options," says Tim Milazzo, CEO and Co-founder of StackSource. "Our goal is to empower borrowers by providing them with transparent and data-driven insights, facilitating more efficient and effective financing decisions, along with the guidance and support of an expert Capital Advisor."

More on S For Story

- NBA Champion Lamar Odom Launches Anti-Addiction Meme Coin, Ushering in a Disruptive Innovation in Web3

- Aureli Construction Sets the Standard for Seamless Home Additions in Greater Boston

- Do You Know Why Nobody Sits Like the French?

- ScreenPoints Puts Film Investors in the Credits—and in the Money With New FinTech Platform

- Pathways to Adulthood Conference May 17 at Melville Marriott Honoring NYS Assembly Member Jodi Giglio, Suffolk County Legislator Nick Caracappa

This enhancement reinforces StackSource's commitment to leveraging technology to streamline and optimize the commercial real estate financing experience.

About StackSource

StackSource is a tech-enabled commercial real estate finance platform. The company connects investors who are developing or acquiring commercial properties with financing options including banks, insurance companies, debt funds, private equity, and other alternative capital providers through a simple, transparent online process. StackSource, ranked #777 on the Inc. 5000 list of fastest-growing private companies, is taking the best of commercial mortgage brokerage and updating it for the 21st century. Learn more at StackSource.com.

Source: StackSource

0 Comments

Latest on S For Story

- ABM for Good™ Launches First Project with Build Change

- ImagineX, in Collaboration with Qualys, Launches New mROC Services to Transform Enterprise Cyber Risk Management

- Ditch Micromanagement: New Leadership Book for Results-Driven, Accountability-Based Teams

- Jay Tapp was named Managing Director in British Columbia

- Hubei Heavy Equipment Makes a Striking Appearance at CIMT and Competes with International Brands

- 20 Patents Issued Worldwide, Cementing Company Leadership. First Ever Cable-Free 12-Lead ECG: HeartBeam, Inc. (Stock Symbol: BEAT)

- NASDAQ Uplisting for Higher Market Exposure and Wide Corporate Benefits to AI Boosted Marketing Company On Track Towards $1 Billion Revenue by 2027

- Congressional Men's Health Caucus Shows Bipartisan Consensus and Focus on Prevention, Mental Health, and Closing the Lifespan Gap

- DuoKey, Axiomtek and Blue Edge Network Partner to Enhance Smart Cities with Privacy-Preserving Urban Safeguarding and Fleet Management

- Arlina A.'s A LETTER TO PAWTONE Explores Childhood Innocence and the Moments That Shape Us

- Austin Keen Joins WakeFX RopePal as Official Brand Ambassador

- Bonelli Systems Expands Managed IT Services Nationwide, Leveraging Microsoft Azure Expertise

- $4.3 Million Patent Application Waiver Fee Granted by FDA on New Drug Application Fee for Treatment Addressing Suicidal Depression & PTSD: NRX Pharma

- Whistleblower Claims Dental Patient Deaths Likely Due to Book Ban

- xREnergy up as much as +3,094,634% on first day listed on the XRP Ledger. Ticker : $XRE

- Psychiatry's Legacy of Racism and Coercion Highlighted in Restraint Deaths

- New Book 'Cybersecurity Leadership' Guides SME Leaders to Make Smart, Strategic Security Decisions

- "Stop scrolling and start watching" - Beloved film recommendation site Criticker gets a major makeover

- Green Energy Solar Expands with New Offices in Port St. Lucie, West Palm Beach, and Orlando

- Events by Dubsdread Expands Services to The Venue at Lake Lily