Popular on s4story

- Post-Traditional Career Expert Sandra Buatti-Ramos Receives 2025 Top Career Coach Recognition - 334

- The Office of Count Jonathan of Aquitaine Establishes Centre for Education and Diplomacy - 313

- Bookmakers Review: Joe Rogan Favored to Win Inaugural 2025 Golden Globes Podcast of the Year - 289

- The 2025 "Aizu Festival" in Aizu Wakamatsu City will be held September 19–21 - 289

- Ubleu Crypto Group Achieves FinCEN Registration and Colorado Incorporation, Accelerating U.S. Market Entry - 288

- New Urban Fantasy Series 'Secret Empires' Brings Ancient Magic and Hidden Wars to Life - 283

- Iterators Named Preferred Accessibility Testing Vendor by MIT - 282

- Memoir Surge and Publishing Innovation: Independent Houses Lead the Next Chapter of Literary Culture - 224

- Sober.Buzz Adds Second Podcast, "Spreading the Good BUZZ" Guest List Grows, Numbers Continue Growing Globally, All While Josh and Heidi Tied the Knot - 210

- Love Death + Explosives: Thomas Pynchon's Polipsychology | An Essay by Michael Finney - 210

Similar on s4story

- Nebuvex Exchange Announces Completion of Beta Testing, Prepares Q3 2025 US Market Launch

- AureaVault Launches U.S.-Licensed Cryptocurrency Exchange with Enhanced Security Features

- IOTAP Named to 2025 Inc. 5000 List of America's Fastest-Growing Private Companies

- $5 - $20 Million in Sales for 2026; $25 - $40 Million for 2027 Projected with NASA Agreements; New MOU Signed to Improve Solar Tech in Space

- Growth Acceleration via Strategic Reverse Split After $10 Million Acquisition for Concerts.com and TicketStub.com; AI Powered Sports/Entertainment Co

- 500% Increase in Revenue for Q2 with Acquisition Plans Including UK Telecom 3D Design/Modeling Company for Global AI Drone & Quantum Computing Leader

- K2 Integrity and Rafidain Bank Launch Strategic Partnership to Strengthen Financial Integrity

- Joint Venture for Expansion Into Asset-Backed Real Estate; $100 Million Initiative via Offering of Shares at Over $4 for Digital Assets: $OFAL

- $1 Billion Revenue Target, $15M EBITDA Run Rate Plan, and a Breakout Moment for This Global Tech Powerhouse: IQSTEL, Inc. (N A S D A Q: IQST):

- EIG Global Trust Unveils Groundbreaking Gold Backed Digital Currency Stablecoin Ecosystem Poised to Accelerate the Global Digital Asset Transformation

First Bancorp of Indiana, Inc. Announces Financial Results and Cash Dividend

S For Story/10670276

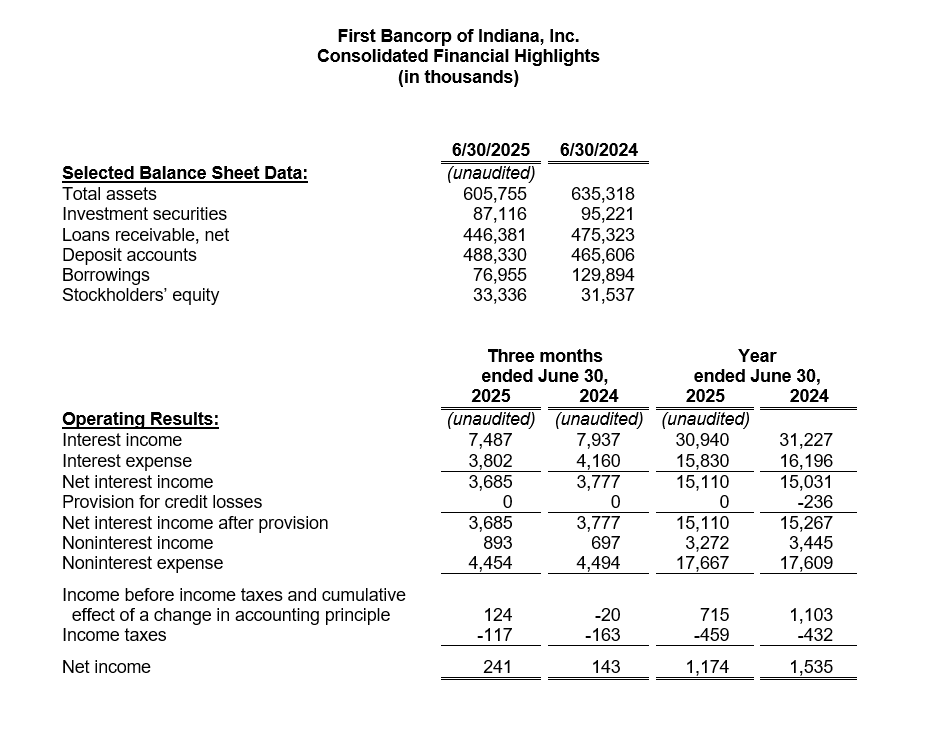

EVANSVILLE, Ind. - s4story -- First Bancorp of Indiana, Inc. (OTCPK:FBPI), the holding company (the "Company") for First Federal Savings Bank (the "Bank"), reported earnings of $241,000 ($0.14 per diluted common share) for the fourth fiscal quarter ended June 30, 2025, compared to $143,000 ($0.09 per diluted common share) for the same quarter a year ago. Likewise, earnings for the fiscal year ended June 30, 2025 totaled $1.17 million ($0.69 per diluted common share), compared to $1.54 million ($0.91 per diluted common share) for the prior fiscal year. Annual earnings equate to a return on average assets ("ROAA") of 0.19% and a return on average equity ("ROAE") of 3.55%. This compares to an annualized ROAA of 0.24% and an annualized ROAE of 5.06% for the prior fiscal year.

Net interest income for the fiscal year ended June 30, 2025 improved modestly from the prior fiscal year. Lower loan production totals this fiscal year outpaced the higher interest rates earned on newly originated loans and repricing adjustable-rate loans. Interest expense declined as local deposit rates moderated, and the Bank reduced higher costing wholesale funding. The Company's net interest margin ("NIM"), as a percentage of average interest-earning assets, was 2.65% for the twelve months ended June 30, 2025, an improvement from the 2.56% reported for the same period last year. Gains on loan sales declined in fiscal 2025 as higher loan rates slowed loan origination volume. Non-interest expenses for the year increased by less than one percent as a result of higher data processing costs and professional fees, partially offset by lower compensation expenses and prudent overhead cost reductions.

The securities portfolio, which is primarily composed of investment-grade municipal bonds and obligations of US government agencies, declined to $87.1 million on June 30, 2025, following the sale of $5.3 million of securities earlier in the fiscal year.

Net loans outstanding, which totaled $446.3 million on June 30, 2025, declined $28.9 million from one year ago, due in part to the sale of a $13.3 million pool of single-family mortgage loans in December. Given the higher interest rate environment, commercial loan production slowed to $27.2 million for the fiscal year. Single-family mortgage loan production added $33.0 million during the same timeframe, with construction lending accounting for twenty percent of this activity. Consumer lending originations, which included auto loans, personal loans, and home equity loans and lines of credit, totaled $13.7 million.

No provision for credit losses on loans was recorded in the twelve months ended June 30, 2025, compared to a recovery of $236,000 for the twelve months ended June 30, 2024. Net loan charges totaled $334,000 for the fiscal year. The ratio of loans 90 days or more delinquent or loans on nonaccrual status to total loans was 0.42% on June 30, 2025, compared to 0.38% a year ago. Notably, this ratio is reduced from 1.76% as reported on December 31, 2024, primarily as the result of the successful restructuring of two large commercial relationships. Overall, the allowance for credit losses, including reserves for investment securities and unfunded commitments, stood at $5.31 million at June 30, 2025, compared to $5.65 million at June 30, 2024. The portion of the allowance attributed to the loan portfolio represented 1.13% of at-risk loans at June 30, 2025, compared to 1.12% at June 30, 2024. Although management believes that the allowance is adequate, a slowing economy, higher interest rate environment, and persistent inflation may have an adverse effect on the credit quality of the loan portfolio. Management remains in close contact with our most vulnerable borrowers and will make additional provisions for credit losses as necessary.

More on S For Story

Deposit accounts, totaling $488.3 million on June 30, 2025, have increased by $22.7 million since the beginning of the fiscal year. Higher costing brokered deposits, totaling $28.3 million, were acquired during the third fiscal quarter to replace FHLB advances. Conversely, local deposit rates have moderated in recent months, resulting in the cost of deposits totaling 2.63% for the current quarter and for the fiscal year compared to 2.70% and 2.61% for the quarter and fiscal year ended June 30, 2024, respectively. Similarly, the Company's total cost of funds, including FHLB advances and debt of the holding company, totaled 2.75% for the quarter and 2.77% for the year, compared to 2.84% and 2.74% for the quarter and year ended June 30, 2024, respectively.

As a part of the Bank's liquidity management plan, contingency funding sources are available and liquidity stress tests determine adequacy. At June 30, 2025, First Federal Savings Bank maintained lines of credit totaling $15.0 million at correspondent financial institutions and additional borrowing capacity with the Federal Reserve Bank's discount window ($12.2 million) and the Federal Home Loan Bank ($86.5 million).

Stockholders' equity totaled $33.3 million on June 30, 2025, which includes a $9.7 million fair value reduction to the available for sale securities portfolio given the rapid rise in market interest rate over the last four years. This securities portfolio adjustment is not a part of the regulatory capital calculations, and gains or losses in the securities portfolio are only recognized in earnings if a security is sold. Stockholders' equity totaled $31.5 million on June 30, 2024. The year over year increase in stockholders' equity is primarily due to the Company's earnings for the year and a decrease in the unrealized loss on the Bank's available for sale investment portfolio. Based on the 1,699,786 outstanding common shares at June 30, 2025, the book value per share of FBPI stock was $19.61, compared to $18.76 at June 30, 2024.

On June 30, 2025, the Bank's Tier 1 Leverage, Tier 1 Risk Based Capital and Total Risk Based Capital ratios increased to 8.95%, 12.65% and 13.88%, an improvement from 8.24%, 11.44%, and 12.66% one year ago.

At its August meeting, the Board of Directors of First Bancorp of Indiana, Inc. declared a cash dividend of $0.05 per share, payable to stockholders of record as of September 15, 2025. The dividend will be paid on or about September 30, 2025. On July 29, 2024, the Company announced that the Board had determined to discontinue the payment of dividends as part of an effort to enhance the Bank's capital levels, liquidity and earnings, and to better position the Bank to reduce its higher funding costs. While it is the Board's intent to pay a regular quarterly dividend, the payment of any future dividends will be subject to, among other factors, the Company's and the Bank's financial condition, earnings, and capital requirements.

More on S For Story

This press release may contain statements that are forward-looking, as that term is defined by the Private Securities Litigation Act of 1995 or the Securities and Exchange Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors created thereby. All forward-looking statements are based on current expectations regarding important risk factors including, but not limited to: general economic conditions; prices for real estate in the Company's market areas; the interest rate environment and the impact of the interest rate environment on our business, financial condition and results of operations; our ability to successfully conserve and enhance capital levels, enhance liquidity and earnings, and reduce higher funding costs; the Company's ability to pay future dividends; the Bank's ability to pay dividends to the Company to fund the payment of cash dividends on the Company's common stock, and the ability of the Bank to receive any required regulatory approval or non-objection to do so; changes in the demand for loans or in the quality or composition of our loan or investment portfolios; deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected as a result of changes in relevant accounting or regulatory requirements, among other factors; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the outcome of pending or threatened litigation, or of matters before regulatory agencies; changes in law, governmental policies and regulations; and rapidly changing technology affecting financial services. Accordingly, actual results may differ from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by the Company or any other person that results expressed therein will be achieved. The Company undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported by applicable law.

Net interest income for the fiscal year ended June 30, 2025 improved modestly from the prior fiscal year. Lower loan production totals this fiscal year outpaced the higher interest rates earned on newly originated loans and repricing adjustable-rate loans. Interest expense declined as local deposit rates moderated, and the Bank reduced higher costing wholesale funding. The Company's net interest margin ("NIM"), as a percentage of average interest-earning assets, was 2.65% for the twelve months ended June 30, 2025, an improvement from the 2.56% reported for the same period last year. Gains on loan sales declined in fiscal 2025 as higher loan rates slowed loan origination volume. Non-interest expenses for the year increased by less than one percent as a result of higher data processing costs and professional fees, partially offset by lower compensation expenses and prudent overhead cost reductions.

The securities portfolio, which is primarily composed of investment-grade municipal bonds and obligations of US government agencies, declined to $87.1 million on June 30, 2025, following the sale of $5.3 million of securities earlier in the fiscal year.

Net loans outstanding, which totaled $446.3 million on June 30, 2025, declined $28.9 million from one year ago, due in part to the sale of a $13.3 million pool of single-family mortgage loans in December. Given the higher interest rate environment, commercial loan production slowed to $27.2 million for the fiscal year. Single-family mortgage loan production added $33.0 million during the same timeframe, with construction lending accounting for twenty percent of this activity. Consumer lending originations, which included auto loans, personal loans, and home equity loans and lines of credit, totaled $13.7 million.

No provision for credit losses on loans was recorded in the twelve months ended June 30, 2025, compared to a recovery of $236,000 for the twelve months ended June 30, 2024. Net loan charges totaled $334,000 for the fiscal year. The ratio of loans 90 days or more delinquent or loans on nonaccrual status to total loans was 0.42% on June 30, 2025, compared to 0.38% a year ago. Notably, this ratio is reduced from 1.76% as reported on December 31, 2024, primarily as the result of the successful restructuring of two large commercial relationships. Overall, the allowance for credit losses, including reserves for investment securities and unfunded commitments, stood at $5.31 million at June 30, 2025, compared to $5.65 million at June 30, 2024. The portion of the allowance attributed to the loan portfolio represented 1.13% of at-risk loans at June 30, 2025, compared to 1.12% at June 30, 2024. Although management believes that the allowance is adequate, a slowing economy, higher interest rate environment, and persistent inflation may have an adverse effect on the credit quality of the loan portfolio. Management remains in close contact with our most vulnerable borrowers and will make additional provisions for credit losses as necessary.

More on S For Story

- Indies United is pleased to present our September 2025 book releases

- Floridians Educated on Mental Health Abuses at the "Psychiatry: An Industry of Death" Traveling Exhibit in Orlando

- History Matters: Book Recommendations for September

- The Ann. El Quixote Festival - Children's Voices Launches the 'Roots and Laughter' Anthology in P.R

- Nebuvex Exchange Announces Completion of Beta Testing, Prepares Q3 2025 US Market Launch

Deposit accounts, totaling $488.3 million on June 30, 2025, have increased by $22.7 million since the beginning of the fiscal year. Higher costing brokered deposits, totaling $28.3 million, were acquired during the third fiscal quarter to replace FHLB advances. Conversely, local deposit rates have moderated in recent months, resulting in the cost of deposits totaling 2.63% for the current quarter and for the fiscal year compared to 2.70% and 2.61% for the quarter and fiscal year ended June 30, 2024, respectively. Similarly, the Company's total cost of funds, including FHLB advances and debt of the holding company, totaled 2.75% for the quarter and 2.77% for the year, compared to 2.84% and 2.74% for the quarter and year ended June 30, 2024, respectively.

As a part of the Bank's liquidity management plan, contingency funding sources are available and liquidity stress tests determine adequacy. At June 30, 2025, First Federal Savings Bank maintained lines of credit totaling $15.0 million at correspondent financial institutions and additional borrowing capacity with the Federal Reserve Bank's discount window ($12.2 million) and the Federal Home Loan Bank ($86.5 million).

Stockholders' equity totaled $33.3 million on June 30, 2025, which includes a $9.7 million fair value reduction to the available for sale securities portfolio given the rapid rise in market interest rate over the last four years. This securities portfolio adjustment is not a part of the regulatory capital calculations, and gains or losses in the securities portfolio are only recognized in earnings if a security is sold. Stockholders' equity totaled $31.5 million on June 30, 2024. The year over year increase in stockholders' equity is primarily due to the Company's earnings for the year and a decrease in the unrealized loss on the Bank's available for sale investment portfolio. Based on the 1,699,786 outstanding common shares at June 30, 2025, the book value per share of FBPI stock was $19.61, compared to $18.76 at June 30, 2024.

On June 30, 2025, the Bank's Tier 1 Leverage, Tier 1 Risk Based Capital and Total Risk Based Capital ratios increased to 8.95%, 12.65% and 13.88%, an improvement from 8.24%, 11.44%, and 12.66% one year ago.

At its August meeting, the Board of Directors of First Bancorp of Indiana, Inc. declared a cash dividend of $0.05 per share, payable to stockholders of record as of September 15, 2025. The dividend will be paid on or about September 30, 2025. On July 29, 2024, the Company announced that the Board had determined to discontinue the payment of dividends as part of an effort to enhance the Bank's capital levels, liquidity and earnings, and to better position the Bank to reduce its higher funding costs. While it is the Board's intent to pay a regular quarterly dividend, the payment of any future dividends will be subject to, among other factors, the Company's and the Bank's financial condition, earnings, and capital requirements.

More on S For Story

- Clay James Graces the Cover of RockLan One Magazine

- New Memoir Inspires Recovery After Stage 3 Cancer Diagnosis

- Transform Your Eyes: How to Lift Away Drooping or Hooded Eyelids

- 1830 First Edition Book of Mormon to be sold at Auction

- Satya Nauth Announces the Release of Mom Take Center Stage

This press release may contain statements that are forward-looking, as that term is defined by the Private Securities Litigation Act of 1995 or the Securities and Exchange Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors created thereby. All forward-looking statements are based on current expectations regarding important risk factors including, but not limited to: general economic conditions; prices for real estate in the Company's market areas; the interest rate environment and the impact of the interest rate environment on our business, financial condition and results of operations; our ability to successfully conserve and enhance capital levels, enhance liquidity and earnings, and reduce higher funding costs; the Company's ability to pay future dividends; the Bank's ability to pay dividends to the Company to fund the payment of cash dividends on the Company's common stock, and the ability of the Bank to receive any required regulatory approval or non-objection to do so; changes in the demand for loans or in the quality or composition of our loan or investment portfolios; deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected as a result of changes in relevant accounting or regulatory requirements, among other factors; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the outcome of pending or threatened litigation, or of matters before regulatory agencies; changes in law, governmental policies and regulations; and rapidly changing technology affecting financial services. Accordingly, actual results may differ from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by the Company or any other person that results expressed therein will be achieved. The Company undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported by applicable law.

Source: First Bancorp of Indiana Inc

0 Comments

Latest on S For Story

- IRL Investigations Combines Decades of Experience with Modern Digital Expertise

- New Leadership Model – Never Fire Anyone – Released Today

- New Book Release By New Author Brent Cornish

- AureaVault Launches U.S.-Licensed Cryptocurrency Exchange with Enhanced Security Features

- IOTAP Named to 2025 Inc. 5000 List of America's Fastest-Growing Private Companies

- Lineus Medical and Venture Medical Sign New Zealand Distribution Agreement

- Black Plumbing Expands to Cleburne, TX, Bringing Over 30 Years of Trusted Plumbing Service

- From Horror to Heartfelt: How Author Cassondra Windwalker Shifts Gears with her Latest Novel

- $5 - $20 Million in Sales for 2026; $25 - $40 Million for 2027 Projected with NASA Agreements; New MOU Signed to Improve Solar Tech in Space

- Feed Your Hungry Soul: Awaken Your Loving Heart - A Transformative Guide Bridging Medicine and Myst

- New Book: Cold War Sci-Fi Thriller Arrives Today

- BeeCool Bikes Unveils Next-Generation "Super Frame" with Bee Defender Series

- University of South Pacific and Battery Pollution Technologies Forge Strategic Partnership to tackle Battery End-of-Life Challenges in the Pacific

- Shincheonji Tanzania Church Holds Revelation Bible Exam with Local Pastors and Believers

- Portland Med Spa Expands Service Offerings with Latest Aesthetic Technologies

- Growth Acceleration via Strategic Reverse Split After $10 Million Acquisition for Concerts.com and TicketStub.com; AI Powered Sports/Entertainment Co

- Hollywood Casting Director's Book Hits #1 on Amazon Before Release

- OddsTrader Projects Three Potential Elimination Games in Week 1 of College Football

- Century Fasteners Corp. Exhibiting at the 2025 International Fastener Expo

- Canvas Cloud AI Launches to Transform Cloud Education From Memorization to Mastery