Popular on s4story

- Open Art Call | The Art of Artificial Intelligence | Copenhagen - 281

- Dylan Johnson Releases New Book - The Manipulator's Gambit - 251

- Premieres of 10th Annual NY Dog Film Festival & 8th Annual NY Cat Film Festival on Sunday, October 26, 2025 to Benefit Animal Lighthouse Rescue - 248

- Entry Level Acting in LA 2025 Workbook to be Released in West Hollywood, California USA 2pm 10/11/25 - 244

- Leading Digital Finance Platform YNQTL Launches Revolutionary Web3 Digital Asset Trading Platform - 241

- 3E Launches First AI Agent Designed to Respond with Empathy for College Recruitment - 241

- IDCXS Addresses Crypto Trading Pain Points with 2 Million TPS Processing and Multi-Layer Security Architecture - 237

- 120% Revenue Surge with Four Straight Profitable Quarters Signal a Breakout in the Multi-Billion Dollar Homebuilding Market: Innovative Designs $IVDN - 235

- Mamta Jha Mishra Releases New Book: "Energy Management: Mantras for Caregivers" - 230

- New Book Reveals 10 Simple "Stress Hacks" Hidden in the Human Body - 224

Similar on s4story

- Six-Figure Chicks Book Series 96 Authors, 6 Volumes Published to Empower and Mentor Women Nationwide

- $150 Million Financing Initiates N A S D A Q's First Tether Gold Treasury Combining the Stability of Physical Gold with Blockchain $AURE

- Podcast for Midlife Women Entrepreneurs Celebrates 100th Episode with Rhea Lana's Founder and CEO

- OddsTrader Examines the NHL Presidents Trophy Curse: Why Regular-Season Success Rarely Leads to Playoff Glory

- Coming Up this Weekend on CNBC Mike Milligan Joins Tom Hegna on "Financial Freedom with Tom Hegna"

- $73.6M Pipeline, $10M Crypto Play & Legal Firepower: Why Investors Are Watching Cycurion (N A S D A Q: CYCU) Like a Hawk

- QView Medical and Eve Wellness Announce Partnership to Advance Direct-to-Consumer Breast Cancer Screening With FDA-Approved AI

- New Article Reveals Common Pricing Pitfalls in Flooring Projects — And How to Avoid Them

- Airbus Defence and Space and Omnitronics Sign MoU to Advance Interoperability in Critical Communications

- NASA Agreements, New Ocean Exploration Applications Added to Partnerships with Defiant Space Corp and Emtel Energy USA for Solar Tech Leader: $ASTI

$1 Billion Revenue Target, $15M EBITDA Run Rate Plan, and a Breakout Moment for This Global Tech Powerhouse: IQSTEL, Inc. (N A S D A Q: IQST):

S For Story/10669804

$IQST Institutions are Buying...Why? IQST is Undervalued at $7

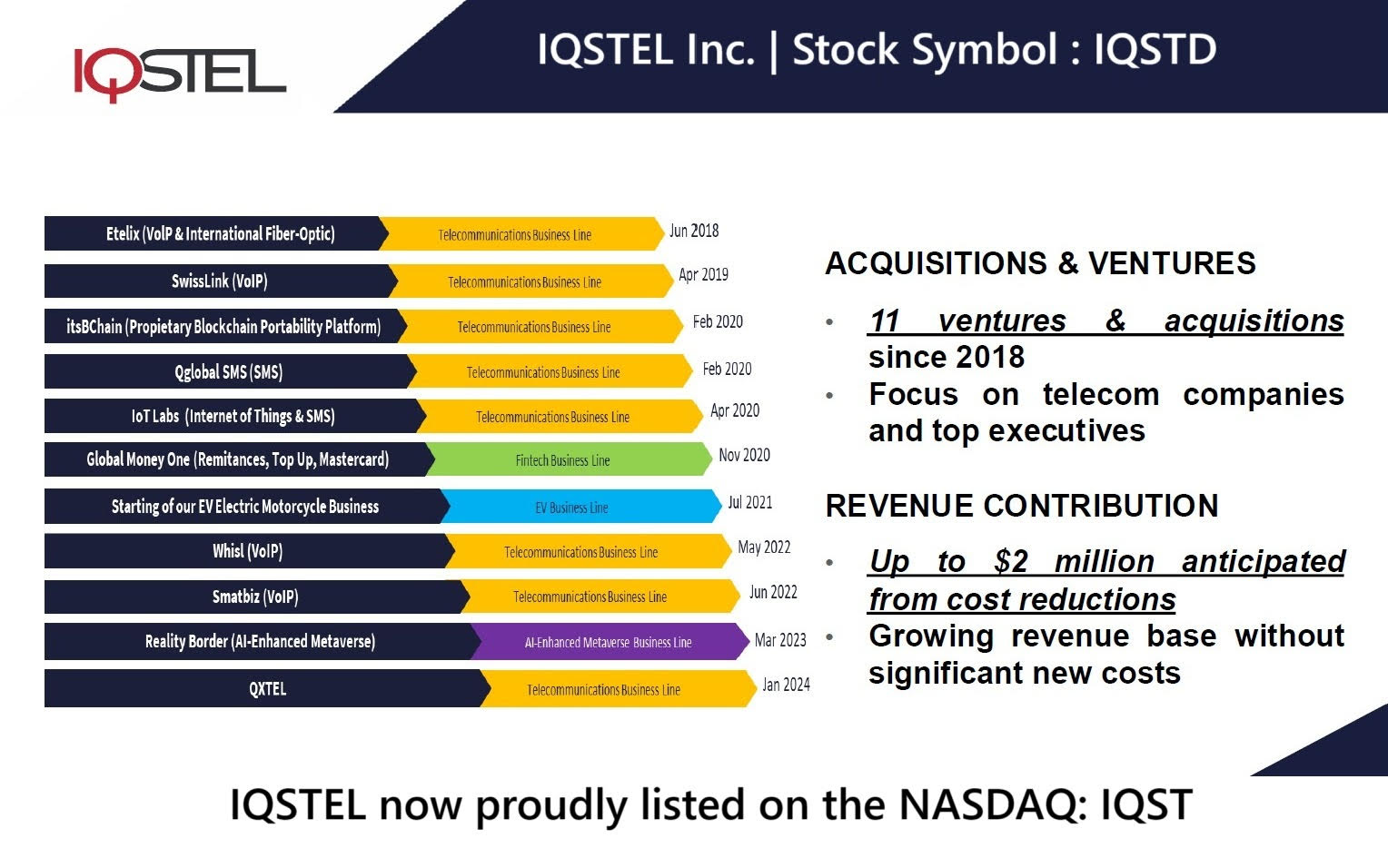

CORAL GABLES, Fla. - s4story -- August 2025 — In a marketplace increasingly defined by rapid innovation, IQSTEL, Inc. (N A S D A Q: IQST) is emerging as a rare standout — delivering real revenues, rapid profitability milestones, and strategic diversification across the most exciting sectors in tech: telecom, fintech, electric vehicles, artificial intelligence, and cybersecurity.

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on S For Story

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

Recent Highlights Validating the Strategy

Analyst Endorsement and Institutional Interest Rising

More on S For Story

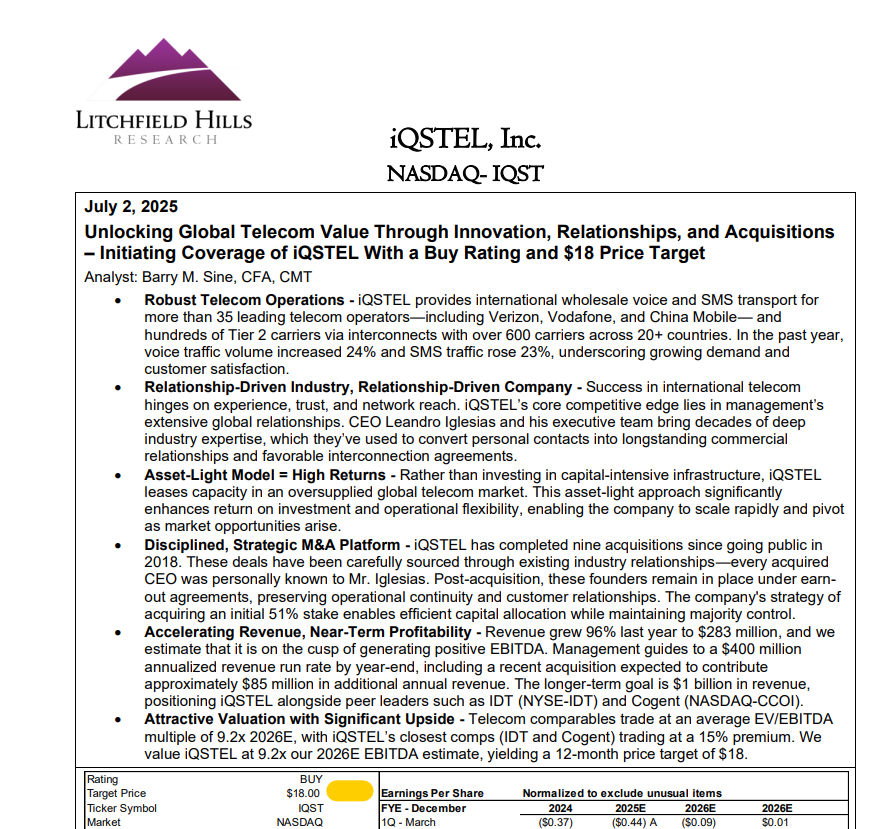

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

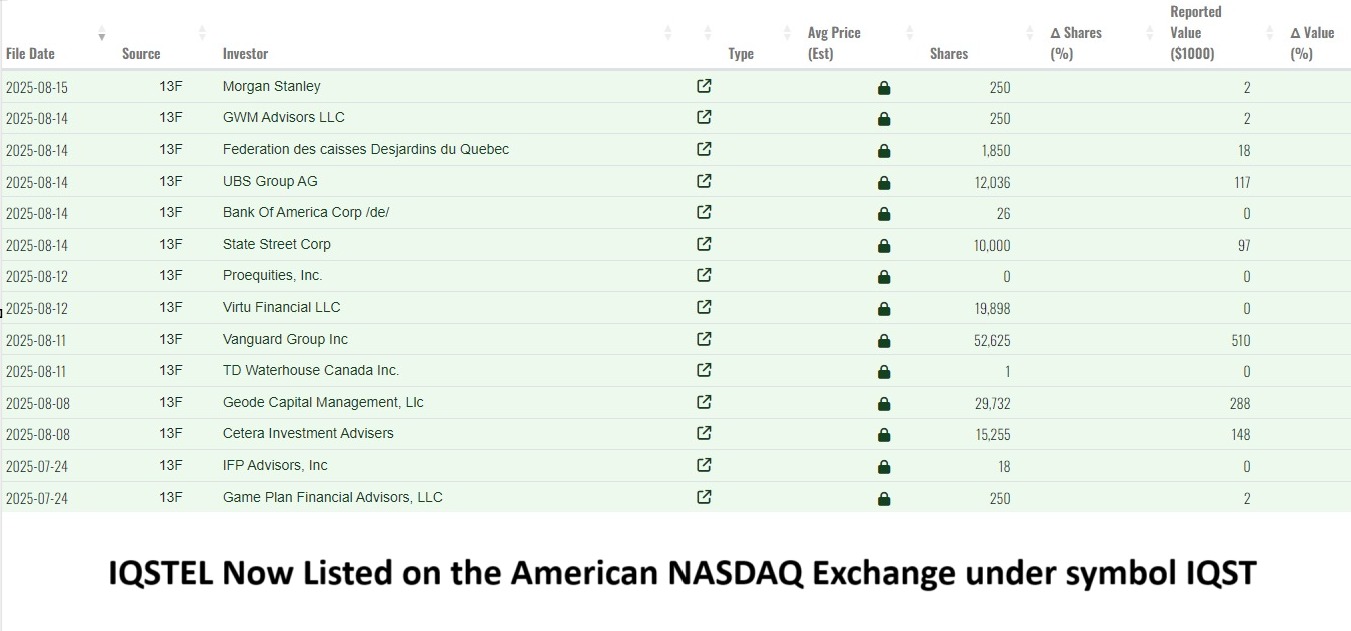

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

- $35M in July revenue alone — puts the company ahead of schedule on its $400M+ run rate

- $17.41 in assets per share, equity per share up to $4.84

- $6.9M in debt eliminated, or nearly $2 per share, strengthening the balance sheet

- Litchfield Hills Research reaffirms $18 price target, citing strong Q2 performance

- New dividend catalyst: IQST shareholders to receive shares in ASII as part of Nasdaq uplisting strategy

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on S For Story

- Amazon Bestselling Author, Apostle Tonya releases autographed copies of "Wonder & Glory"

- LSC Destruction Launches Cutting-Edge Cryptocurrency Scanning to Hard Drive Destruction Services

- No Better Time Than Now to Publish A Life Story

- History Matters: Book Recommendations for October

- $150 Million Financing Initiates N A S D A Q's First Tether Gold Treasury Combining the Stability of Physical Gold with Blockchain $AURE

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

- Telecom: $600M+ in historical revenue, strong recurring business, trusted by 600+ operators worldwide

- Fintech: Expansion accelerated by the July 1st acquisition of GlobeTopper, forecasting $34M in H2 revenue and positive EBITDA

- AI: Launch of IQ2Call — an AI-powered, multilingual call center disrupting the $750B global telecom customer service market

- Cybersecurity & Blockchain: Active product development underway to support enterprise and consumer needs globally

Recent Highlights Validating the Strategy

- Q2 2025 Financials (Ended June 30, 2025):

- Gross revenues grew 17% YoY (100% organic growth)

- Gross margin improved by 7.45%

- Net shareholder equity up 20% in 6 months

- Common equity conversions absorbed by the market with no dilution impact

- Equity Exchange and Dividend Partnership with CYCU:

- IQST and CYCU signed an MOU for mutual equity stakes and shareholder dividends in each company — strengthening IQST's shareholder value proposition

Analyst Endorsement and Institutional Interest Rising

More on S For Story

- Podcast for Midlife Women Entrepreneurs Celebrates 100th Episode with Rhea Lana's Founder and CEO

- What If Help Could Come Before the Fall?

- Digi 995: Spookyverse — Unlocking the Multiverse of the Digiverse

- Fiction author re-imagines Acts of the Apostles with Female Apostles

- Combatting Commercial Clutter: Award-Winning Author Andrew Kooman Releases Gather for Advent

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business

0 Comments

Latest on S For Story

- White Glove Restoration Sends "Help in Boxes" to Support Communities in Ghana

- Ontario Publisher Wins Silver in the 2025 Moonbeam Children's Book Awards for Best Picture Book

- NASA Agreements, New Ocean Exploration Applications Added to Partnerships with Defiant Space Corp and Emtel Energy USA for Solar Tech Leader: $ASTI

- MackinPublic Provides Content and Confidence To US Public Libraries

- Chic and Secure: The Blue Luna Debuts Stylish Keychains with Purpose

- BEC Technologies Showcases Leadership in Private Broadband Ecosystem with Inclusion in UTC's Ecosystem Summary Report

- $500,000 in Stock Dividend for Shareholders in 2025 Sweetens The Pot on Success of Becoming Debt Free with No Convertible Notes or Warrants for $IQST

- Milwaukee Job Corps Center: Essential Workforce Training—Admissions Now Open

- Aissist.io Launches Hybrid AI Workforce to Solve AI Pilot Failure for Customer Support Automation

- New Chapter Book Teaches Courage And The Importance Of Friendship Through Fantasy-Driven Adventure

- Christy Sports Makes Snowsports More Accessible for Families to Get Outside Together

- MainConcept Completes Management Buyout to Become Independent Company

- LIB Industry Expands Full-Series Salt Spray Corrosion Test Chambers to Meet Global Testing Standards

- The Easy Way to Collect Every Wedding Photo from Your Guests - No App Needed

- REPRESENTATION REVOLUTION: FLM TV Network Launches as America's First Truly Diverse Broadcast Network

- New Book Call all Jews to Accept Jesus as the Messiah

- For Nat'l. Novel Writing Month: Check out The Next Big Thing in Entertainment for Books, Movies & TV

- MetroWest wellness: Holliston farmhouse spa unveils Centerpoint Studio

- Cancer Survivor Roslyn Franken Marks 30-Year Milestone with Empowering Gift for Women Survivors

- "Grace & Grit" Helps Mompreneurs Live Boldly in Faith and Purpose