Popular on s4story

- Libraries for Kids International Announces 2026 Board of Directors

- Tawanna Chamberlain Launches New Book, Outsized Ambition: The Blueprint for Going Beyond!

- RNHA Affirms Support for President Trump as Nation Marks Historic Victory for Freedom

- Phillip E Walker's EntryLevelActing.com Actor Employment Advice E-Book Road Map Launches on MLK Day

- Lacy Hendricks Earns Prestigious MPM® Designation from NARPM®

- New Middle Grade Novel A New Way to Know Releases February 2, 2026

- New Anthology Release by Dark Moon Books: HORROR LIBRARY, VOLUME 9

- The 22% Tax Reality: Finland's New Gambling Law Creates a "Fiscal Trap" for Grey Market Casino Players

- Thorn & Bloom Magazine Launches Fourth Issue, "Radical Joy We Cultivate," to Close the Year with Joy

Similar on s4story

- Precision Adult Care Expands 24/7 Adult In-Home Care Services to Meet Growing Demand in the Coachella Valley

- Openchannelflow Wins Web Excellence Award for Outstanding Digital Experience

- STS Capital Partners' Andy Harris Co-Authors 'The Extraordinary Exit,' A Practical Guide for Business Owners Considering a Sale

- UK Financial Ltd Lists MayaFund (MFUND) ERC-20 Token on CATEX Exchange Ahead of Planned ERC-3643 Upgrade

- Roblox and Solsten Alliances; a Stronger Balance Sheet and Accelerated Growth Through AI, Gaming, and Strategic Partnerships for Super League: $SLE

- Scoop Social Co. Partners with Fairmont Hotels & Resorts to Elevate Summer Guest Experiences with Italian Inspired Gelato & Beverage Carts

- Building a $145M AI-Powered Marine Platform as Listings Surge, Global Expansion Begins, OTH Shares Trade at a Discount: Off The Hook YS (N Y S E: OTH)

- Americans Need $1.26 Million to Retire But Have Just $38K Saved — So They're Building Income Instead

- Does EMDR Really Work? New Article Explores How Trauma Gets Stuck in the Brain and How Healing Begins

- New Medium Article Explores Why Emotional Conversations Fail and What Most People Don't Understand About Connection

Record Revenue, Tax Tailwinds, and AI-Driven Scale: Why Off The Hook YS Inc. Is Emerging as a Standout in the $57 Billion U.S. Marine Market

S For Story/10680243

Off The Hook YS Inc. (NYSE American: OTH) $OTH is Projected to Reach $140 to $145 Million in 2026 and is Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry

WASHINGTON, N.C. - s4story -- Off The Hook YS Inc. (NYSE American: OTH) is quietly transforming the fragmented pre-owned boat market into a data-driven, institutional-grade platform—and investors are beginning to take notice.

Following its November IPO, the company reported record nine-month revenue of $82.6 million, up 19.3% year over year, alongside accelerating unit growth, expanding margins, and a powerful demand catalyst stemming from newly reinstated 100% bonus depreciation for qualifying boat purchases.

With 2026 revenue guidance of $140–$145 million, OTH is positioning itself as one of the most compelling small-cap growth stories in the U.S. marine industry.

A Market Leader in a Massive, Underserved Industry

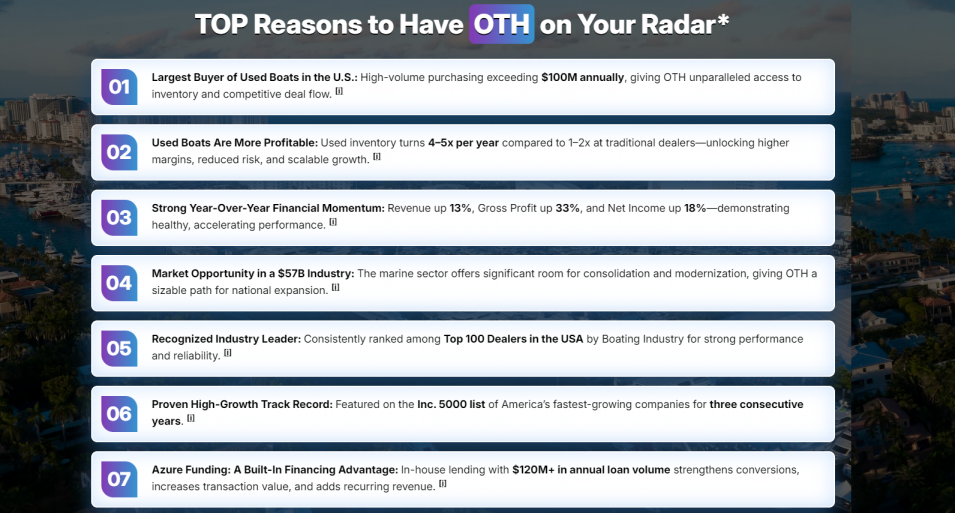

Founded in 2012 by President Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales.

The opportunity is significant. The U.S. marine industry is valued at approximately $57 billion, with continued growth driven by recreation, luxury demand, and business-use vessels. In parallel, the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, highlighting durable long-term tailwinds.

OTH has consistently earned recognition on the Inc. 500 and has been ranked among the Top 100 Boat Dealers in the United States, underscoring its operational credibility and scale.

Technology as a Competitive Moat

What differentiates OTH from traditional boat dealers is its AI-assisted valuation tools and data-driven sales platform, which bring speed, transparency, and liquidity to a historically opaque market.

More on S For Story

By leveraging proprietary data and analytics, OTH accelerates transaction cycles, improves pricing accuracy, and enhances inventory turnover—creating what some analysts describe as a form of structural arbitrage in marine liquidity.

This digital transformation thesis is explored in depth in a newly released BD Deep Investor Research Report, titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

Financial Momentum Continues Post-IPO

On December 15, OTH reported results for the third quarter ended September 30, 2025, marking its first earnings update following its IPO.

Third Quarter 2025 Highlights

Nine-Month 2025 Highlights

Importantly, unit growth continues to outpace revenue growth—an indicator of improving market penetration and long-term operating leverage.

A Powerful Tax Catalyst: 100% Bonus Depreciation

In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying business assets, including boats and yachts, through January 19, 2026.

For eligible buyers using vessels more than 50% for legitimate business purposes, this incentive allows the entire purchase price to be deducted in year one—dramatically improving after-tax economics.

More on S For Story

"This incentive is a game-changer," said Ruegg. "A buyer who meets the IRS requirements can deduct the entire cost of the boat in year one. This has already boosted demand, and we expect interest to surge even further."

As the national leader in pre-owned boat inventory, OTH is uniquely positioned to capitalize on this demand surge, offering one of the broadest all-brand selections in the country—a key advantage over competitors with limited inventories.

Expansion Into Luxury Brokerage

To further strengthen its presence in high-value transactions, OTH recently announced the development of a new Jupiter, Florida office, which will serve as headquarters for Autograph Yacht Group (AYG), its luxury brokerage division led by industry veteran Mike Burke.

The facility includes office space and six on-site boat slips, providing direct inventory access in one of the most active yachting markets in the U.S. The build-out is expected to be completed in early 2026.

Clear Line of Sight to 2026 Growth

Management has issued full-year 2026 revenue guidance of $140–$145 million, reflecting confidence in continued demand, expanding broker productivity, tax-driven buying activity, and platform scalability.

With:

Off The Hook YS Inc. is emerging as a next-generation consolidator and liquidity leader in the U.S. marine market.

Investor Resources

Ticker: NYSE American: OTH

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Following its November IPO, the company reported record nine-month revenue of $82.6 million, up 19.3% year over year, alongside accelerating unit growth, expanding margins, and a powerful demand catalyst stemming from newly reinstated 100% bonus depreciation for qualifying boat purchases.

With 2026 revenue guidance of $140–$145 million, OTH is positioning itself as one of the most compelling small-cap growth stories in the U.S. marine industry.

A Market Leader in a Massive, Underserved Industry

Founded in 2012 by President Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales.

The opportunity is significant. The U.S. marine industry is valued at approximately $57 billion, with continued growth driven by recreation, luxury demand, and business-use vessels. In parallel, the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, highlighting durable long-term tailwinds.

OTH has consistently earned recognition on the Inc. 500 and has been ranked among the Top 100 Boat Dealers in the United States, underscoring its operational credibility and scale.

Technology as a Competitive Moat

What differentiates OTH from traditional boat dealers is its AI-assisted valuation tools and data-driven sales platform, which bring speed, transparency, and liquidity to a historically opaque market.

More on S For Story

- Robert D. Botticelli Promoted to Century Fasteners Corp. – Director of Sales

- Openchannelflow Wins Web Excellence Award for Outstanding Digital Experience

- STS Capital Partners' Andy Harris Co-Authors 'The Extraordinary Exit,' A Practical Guide for Business Owners Considering a Sale

- One-Click Pro Audio for Streamers: "VoiceSterize" Automates Noise Reduction & Mastering on Mac

- Sole Publishing Announces Essential Parenting Book for Families Navigating the Teen Years

By leveraging proprietary data and analytics, OTH accelerates transaction cycles, improves pricing accuracy, and enhances inventory turnover—creating what some analysts describe as a form of structural arbitrage in marine liquidity.

This digital transformation thesis is explored in depth in a newly released BD Deep Investor Research Report, titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

Financial Momentum Continues Post-IPO

On December 15, OTH reported results for the third quarter ended September 30, 2025, marking its first earnings update following its IPO.

Third Quarter 2025 Highlights

- Revenue of $24.0 million

- 112 boats sold, up 51% year over year

- Second-highest quarterly unit volume in company history

- Gross profit of $3.0 million

- Adjusted EBITDA of $0.5 million

- Net loss narrowed to $0.07 million

- Launch of Autograph Yacht Group, a luxury brokerage division

- Addition of 10 new brokers

Nine-Month 2025 Highlights

- Record revenue of $82.6 million, up 19.3%

- 310 boats sold, up 24.4%

- Net income of $0.8 million

- Gross profit of $8.4 million, up $1.5 million year over year

- Adjusted EBITDA of $2.6 million

Importantly, unit growth continues to outpace revenue growth—an indicator of improving market penetration and long-term operating leverage.

A Powerful Tax Catalyst: 100% Bonus Depreciation

In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying business assets, including boats and yachts, through January 19, 2026.

For eligible buyers using vessels more than 50% for legitimate business purposes, this incentive allows the entire purchase price to be deducted in year one—dramatically improving after-tax economics.

More on S For Story

- New Children's Book "On the Ranch with Cowboy Luke" Celebrates Faith, Family, and Ranch Life

- From Factory Floor to Community Heart: The Rebel Spirit of Wisconsin's Wet Wipe Innovators

- SECRET PALM BEACH: A Guide to the Weird, Wonderful and Obscure - New Book by AMY WOODS

- UK Financial Ltd Lists MayaFund (MFUND) ERC-20 Token on CATEX Exchange Ahead of Planned ERC-3643 Upgrade

- Denver Apartment Finders Launches Revamped Denver Tech Center Apartment Location Page

"This incentive is a game-changer," said Ruegg. "A buyer who meets the IRS requirements can deduct the entire cost of the boat in year one. This has already boosted demand, and we expect interest to surge even further."

As the national leader in pre-owned boat inventory, OTH is uniquely positioned to capitalize on this demand surge, offering one of the broadest all-brand selections in the country—a key advantage over competitors with limited inventories.

Expansion Into Luxury Brokerage

To further strengthen its presence in high-value transactions, OTH recently announced the development of a new Jupiter, Florida office, which will serve as headquarters for Autograph Yacht Group (AYG), its luxury brokerage division led by industry veteran Mike Burke.

The facility includes office space and six on-site boat slips, providing direct inventory access in one of the most active yachting markets in the U.S. The build-out is expected to be completed in early 2026.

Clear Line of Sight to 2026 Growth

Management has issued full-year 2026 revenue guidance of $140–$145 million, reflecting confidence in continued demand, expanding broker productivity, tax-driven buying activity, and platform scalability.

With:

- Record revenues

- Rapid unit growth

- A national footprint

- AI-enabled operations

- A rare tax incentive tailwind

- And participation in a multi-decade growth industry

Off The Hook YS Inc. is emerging as a next-generation consolidator and liquidity leader in the U.S. marine market.

Investor Resources

- BD Deep Investor Research Report (Dec. 8, 2025):

Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry

👉 https://www.digitalbdinc.com/report/othdeepresearch12-8-25.pdf - Company Website: www.offthehookyachts.com

- Investor Media: https://compasslivemedia.com/oth/

- Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Ticker: NYSE American: OTH

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on S For Story

- Best Personal Injury Law Firms 2025 - ELA Awards

- Baruch Arcade Launches AI-Powered Gaming Platform on Solana, do I smell an airdrop?

- Expert Law Attorneys 2025 Best Attorneys

- Best Family Law Attorneys Of 2025 - ELA Awards

- Best Criminal Defense Attorneys Of 2025 - ELA Awards

- Indie Sci-Fi Novel Digi 995: The World That Didn't Need Digi Launches Book Five

- Americans Need $1.26 Million to Retire But Have Just $38K Saved — So They're Building Income Instead

- Edison Lloyd Thomas Reaches #1 Bestseller Status After Encouragement From Bestselling Author Raun Shephard

- Does EMDR Really Work? New Article Explores How Trauma Gets Stuck in the Brain and How Healing Begins

- New Medium Article Explores Why Emotional Conversations Fail and What Most People Don't Understand About Connection

- $80 Million Revenue Backlog for AI Cybersecurity Company Building the Future of Integrated Cybersecurity and Public Safety: $CYCU

- The Brave and the Rescued Honors LA Fire Department First Responders

- Slick Cash Loan shares credit score tips for borrowers using bad credit loans

- Crossroads4Hope Welcomes New Trustees to Board of Directors as Organization Enters 25th Year of Caring

- Inside Secondhand Stories: The Hidden Gem Etsy Shop Where Books Are Chosen with Heart

- PromptBuilder.cc Launches AI Prompt Generator Optimized For ChatGPT, Gemini, Grok & Claude

- UK Financial Ltd Advances Compliance Strategy With January 30th CATEX Exchange Listing Of Maya Preferred PRA Preferred Class Regulated Security Token

- NOW OPEN - New Single Family Home Community in Manalapan

- Kintetsu And Oversee Announce New Partnership

- The Myth of Atlantis, Reconsidered Through Forbidden Texts