Popular on s4story

- OneVizion Announces Next Phase of Growth as Brad Kitchens Joins Board of Directors - 141

- Ice Melts. Infrastructure Fails. What Happens to Clean Water? - 131

- Still Using Ice? FrostSkin Reinvents Hydration - 123

- Donna L. Quesinberry, President of DonnaInk Publications, Unveils New Article on Author Monetization - 119

- "They Thought It Was Impossible to Expose Them — This Is Exactly How It Was Done"

- Authoress S.E. Gregg Offers Gold-Signed Copies in 2026"

- Mend Colorado Launches Revamped Sports Performance Training Page

- New Children's Picture Book "Diwa of Mount Luntian" Focuses on Calm, Culture, and Connection for Today's Families

- Cold. Clean. Anywhere. Meet FrostSkin

- Work 365 Delivers Purpose-Built Revenue Operations for Microsoft Cloud for US Government

Similar on s4story

- VENUS Goes Live on CATEX Exchange As UK Financial Ltd Activates The Premier Division Of The Maya Meme's League

- Atlanta Tech Founder Seeks Clarity on Intellectual Property and Innovation Policy

- Special Alert: Undervalued Opportunity: IQSTEL (N A S D A Q: IQST) Positioned for Explosive Multi-Year Growth

- Triple-Digit Growth, Strategic N A S D A Q Uplist, Plus A Scalable Healthcare Rollout Model: Stock Symbol: CDIX

- Lineus Medical's SafeBreak® Vascular Added to Alliant GPO Contract

- 66% of US Bankruptcies Are Medical — So Americans Are Building Businesses That Cover Healthcare Emergencies

- Ludex Partners With Certified Trading Card Association (CTCA) To Elevate Standards And Innovation In The Trading Card Industry

- Gigasoft Solves AI's Biggest Charting Code Problem: Hallucinated Property Names

- ASTI Ignites the Space Economy: Powering SpaceX's NOVI AI Pathfinder with Breakthrough Solar Technology: Ascent Solar Technologies (N A S D A Q: ASTI)

- Hiring has reached a "Digital Stalemate"—Now, an ex-Google recruiter is giving candidates the answers

Record Revenues, Debt-Free Momentum & Shareholder Dividend Ignite Investor Attention Ahead of 2026–2027 Growth Targets: IQSTEL (N A S D A Q: IQST)

S For Story/10679261

IQSTEL, Inc. (N A S D A Q: IQST) $IQST Reports Record Q3 2025 Results with $102.8 Million Quarterly Revenue, 42% Sequential Growth and Strengthened Balance Sheet.

CORAL GABLES, Fla. - s4story -- In a year marked by breakneck expansion across telecommunications, fintech, AI, and next-generation cybersecurity, IQSTEL, Inc. (N A S D A Q: IQST) is emerging as one of Nasdaq's most compelling growth stories. With record-setting financial results, a rapidly strengthening balance sheet, major acquisitions already bearing fruit, and the confirmation of a $500,000 dividend payable in free-trading shares, IQSTEL is signaling to the market that its long-term value creation strategy is taking hold—fast.

Investors watching for the next transformative mid-cap technology contender may now be seeing its early inflection point.

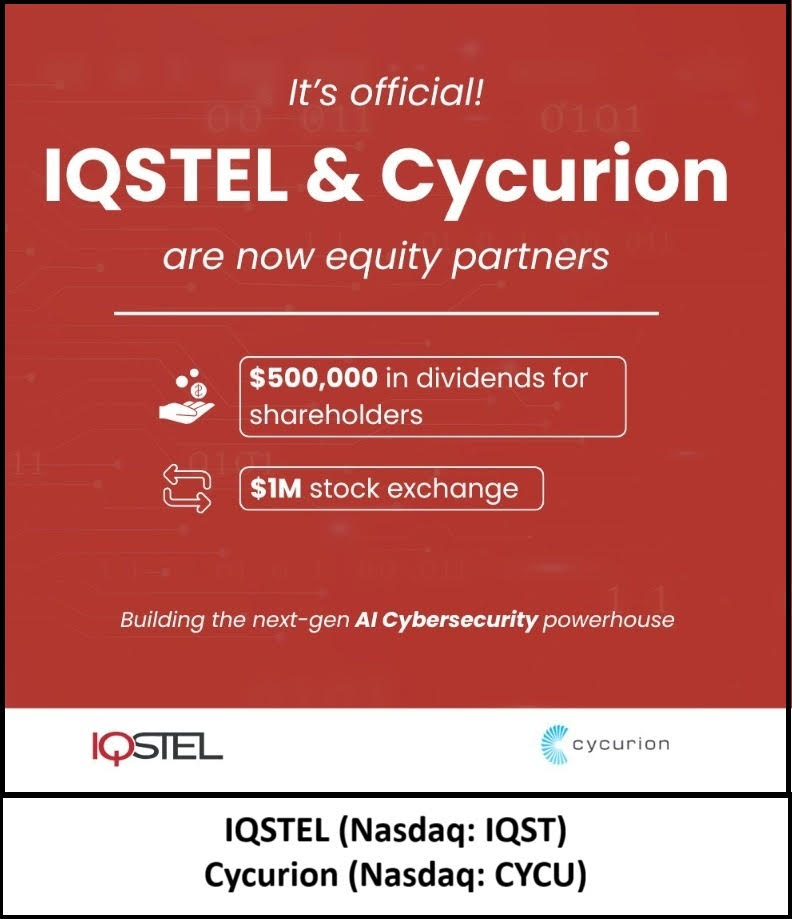

A $500,000 Shareholder Dividend—A Rare Move Among Emerging Tech Firms

On December 3rd, IQSTEL confirmed it will distribute a $500,000 dividend in free-trading IQST common shares. The dividend, calculated at the August 29, 2025 closing price of $6.62, equates to 75,529 shares to be distributed to shareholders of record as of December 15th, with payment on December 30th.

With just 4.37 million shares outstanding, the distribution ratio of 0.0173 per share reflects a meaningful capital return—especially for a debt-free emerging tech company on Nasdaq.

CEO Leandro Iglesias emphasized that this marks the beginning of annual dividends tied directly to performance, stating:

"IQSTEL has fulfilled every promise we made to our shareholders… This $500,000 dividend is a testament to our vision, our execution, and our unwavering dedication to rewarding those who believe in our mission."

In the current market cycle, where investor trust is hard-won, this move could set IQSTEL apart from many of its growth-stage peers.

Record Q3 2025 Results: 42% Sequential Revenue Growth

IQSTEL's financial performance is heating up—rapidly.

More on S For Story

Q3 2025 Revenue: $102.8 million

Up 42% from Q2 and nearly double year-over-year.

The company now reports:

These numbers underscore one of the strongest balance sheets among emerging tech corporations on Nasdaq—particularly for one with global operating reach across 21 countries.

A Debt-Free Nasdaq Company with a Clean Capital Structure

In October, IQSTEL made a strategic leap rarely seen at its stage:

The company eliminated every remaining convertible note and now carries no warrants and no convertible debt.

This resets the company's capitalization to a "clean slate" just as it enters a period of accelerating multi-division growth. For institutional investors wary of dilution risk in small-cap tech, this could be a turning point.

Fintech Expansion Accelerates EBITDA Growth: Globetopper Already Performing

Following its July 1st acquisition of Globetopper, IQSTEL has begun harnessing its powerful international telecom business platform—reaching 600+ global operators—to rapidly scale fintech services.

In Q3 2025 alone:

This division is now a key pillar in IQSTEL's plan to achieve a $15 million EBITDA run rate by 2026.

AI & Cybersecurity: First Phase of Next-Gen Cyber Defense Rolled Out

IQSTEL's AI subsidiary, Reality Border, has completed Phase One of its partnership with Cycurion (N A S D A Q: CYCU)—a U.S. government-certified cybersecurity provider.

Together they are deploying a new breed of AI agents fortified by ARx multi-layer cyber defense, including:

This positions IQSTEL at the nexus of AI-driven telecom solutions and next-generation cyber protection—two sectors increasingly converging.

More on S For Story

Launch of IQ2Call: A Play for a Share of the $750 Billion Global Telecom Market

IQSTEL has rolled out IQ2Call, a vertically integrated AI-powered telecom system that blends:

This expansion positions the company to compete across an addressable market exceeding $750 billion globally.

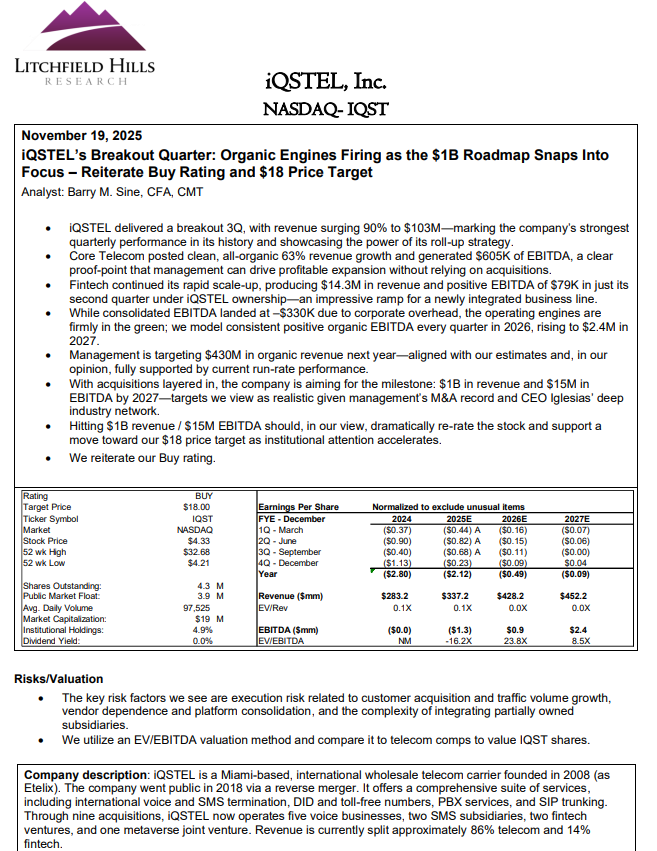

Analyst Coverage: $18 Price Target from Litchfield Hills Research

Litchfield Hills Research recently issued coverage on IQSTEL with a Buy rating and an $18 price target, reflecting confidence in the company's multi-division synergy, strong balance sheet, and aggressive—but measurable—growth milestones.

A Clear Roadmap to $1 Billion Revenue by 2027

IQSTEL projects $340 million in revenue for FY-2025 and sees its path to $1 billion by 2027 supported by:

Given its recent quarterly acceleration, the company's targets—once ambitious—now appear increasingly attainable.

Why Investors Are Paying Close Attention

IQSTEL is entering 2026 with a powerful combination rarely seen among emerging tech companies:

For investors seeking exposure to a diversified, global digital communications and AI company with disciplined capital management and aggressive growth targets, IQSTEL is becoming difficult to ignore.

Investor Resources

Media Contact:

IQSTEL, Inc.

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Investors watching for the next transformative mid-cap technology contender may now be seeing its early inflection point.

A $500,000 Shareholder Dividend—A Rare Move Among Emerging Tech Firms

On December 3rd, IQSTEL confirmed it will distribute a $500,000 dividend in free-trading IQST common shares. The dividend, calculated at the August 29, 2025 closing price of $6.62, equates to 75,529 shares to be distributed to shareholders of record as of December 15th, with payment on December 30th.

With just 4.37 million shares outstanding, the distribution ratio of 0.0173 per share reflects a meaningful capital return—especially for a debt-free emerging tech company on Nasdaq.

CEO Leandro Iglesias emphasized that this marks the beginning of annual dividends tied directly to performance, stating:

"IQSTEL has fulfilled every promise we made to our shareholders… This $500,000 dividend is a testament to our vision, our execution, and our unwavering dedication to rewarding those who believe in our mission."

In the current market cycle, where investor trust is hard-won, this move could set IQSTEL apart from many of its growth-stage peers.

Record Q3 2025 Results: 42% Sequential Revenue Growth

IQSTEL's financial performance is heating up—rapidly.

More on S For Story

- Purple Heart Recipient Honored by Hall of Fame Son In Viral Tribute Sparking National Conversation on Service Fatherhood, Healing and Legacy

- New book published about Ward Lock's RED GUIDES and travelling around Britain

- Amicly Launches as a Safety-First Social App Designed to Help People Build Real, Meaningful Friendships

- Primeindexer Google indexing platform launched by SEO Danmark APS

- Kaltra Introduces New Downward-Spraying Distribution Technology to Boost Microchannel Evaporator Performance

Q3 2025 Revenue: $102.8 million

Up 42% from Q2 and nearly double year-over-year.

The company now reports:

- $232.6 million in revenue through the first nine months of 2025

- $411.5 million revenue run rate

- Adjusted EBITDA of $683,189 in Q3

- Assets of $46.8 million ($12.23 per share)

- Stockholders' equity of $17.8 million ($4.66 per share)—a 50% increase from FY-2024

These numbers underscore one of the strongest balance sheets among emerging tech corporations on Nasdaq—particularly for one with global operating reach across 21 countries.

A Debt-Free Nasdaq Company with a Clean Capital Structure

In October, IQSTEL made a strategic leap rarely seen at its stage:

The company eliminated every remaining convertible note and now carries no warrants and no convertible debt.

This resets the company's capitalization to a "clean slate" just as it enters a period of accelerating multi-division growth. For institutional investors wary of dilution risk in small-cap tech, this could be a turning point.

Fintech Expansion Accelerates EBITDA Growth: Globetopper Already Performing

Following its July 1st acquisition of Globetopper, IQSTEL has begun harnessing its powerful international telecom business platform—reaching 600+ global operators—to rapidly scale fintech services.

In Q3 2025 alone:

- Globetopper contributed ~$16 million in revenue

- And delivered $110,000 in EBITDA, making it cash flow positive

This division is now a key pillar in IQSTEL's plan to achieve a $15 million EBITDA run rate by 2026.

AI & Cybersecurity: First Phase of Next-Gen Cyber Defense Rolled Out

IQSTEL's AI subsidiary, Reality Border, has completed Phase One of its partnership with Cycurion (N A S D A Q: CYCU)—a U.S. government-certified cybersecurity provider.

Together they are deploying a new breed of AI agents fortified by ARx multi-layer cyber defense, including:

- Airweb.ai (Web AI agent)

- IQ2Call.ai (Voice AI agent)

- Built on a secure Model Context Protocol (MCP)

This positions IQSTEL at the nexus of AI-driven telecom solutions and next-generation cyber protection—two sectors increasingly converging.

More on S For Story

- Talentica Announces Winners of Multi-Agent Hackathon 2026

- DonnaInk Publications Announces 2026 2nd Ed. Releases of Two Signature Series by Dr. Gerhard

- Steven Kay's Deceptive Enticements Titles Expand Into Mass Market With New Foreign Publicity Deal

- Cape Cod Author and Coast Guard Veteran Breaks Silence on PTSD in New Memoir 'Hold Fast'

- Award-Winning Author & TEDx Speaker Reggie D. Ford Releases New Children's Book

Launch of IQ2Call: A Play for a Share of the $750 Billion Global Telecom Market

IQSTEL has rolled out IQ2Call, a vertically integrated AI-powered telecom system that blends:

- Real-time communications

- AI agents

- Data analytics

- Cybersecurity infrastructure

This expansion positions the company to compete across an addressable market exceeding $750 billion globally.

Analyst Coverage: $18 Price Target from Litchfield Hills Research

Litchfield Hills Research recently issued coverage on IQSTEL with a Buy rating and an $18 price target, reflecting confidence in the company's multi-division synergy, strong balance sheet, and aggressive—but measurable—growth milestones.

A Clear Roadmap to $1 Billion Revenue by 2027

IQSTEL projects $340 million in revenue for FY-2025 and sees its path to $1 billion by 2027 supported by:

- Organic growth across telecom and fintech

- Strategic acquisitions

- Accelerated roll-out of advanced AI and cybersecurity products

- High-margin product expansion using its existing global customer trust

Given its recent quarterly acceleration, the company's targets—once ambitious—now appear increasingly attainable.

Why Investors Are Paying Close Attention

IQSTEL is entering 2026 with a powerful combination rarely seen among emerging tech companies:

- Record revenue momentum

- Strong EBITDA progression

- Zero debt, zero convertibles, zero warrants

- Annual dividend initiation

- Rapid AI and cybersecurity expansion

- New fintech profitability

- One of the strongest balance sheets in its peer group

For investors seeking exposure to a diversified, global digital communications and AI company with disciplined capital management and aggressive growth targets, IQSTEL is becoming difficult to ignore.

Investor Resources

Media Contact:

IQSTEL, Inc.

Leandro Jose Iglesias, President & CEO

investors@iqstel.com

+1 954-951-8191

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on S For Story

- Gigasoft Solves AI's Biggest Charting Code Problem: Hallucinated Property Names

- Akron Authors Convention Announces Open Call

- ASTI Ignites the Space Economy: Powering SpaceX's NOVI AI Pathfinder with Breakthrough Solar Technology: Ascent Solar Technologies (N A S D A Q: ASTI)

- Hiring has reached a "Digital Stalemate"—Now, an ex-Google recruiter is giving candidates the answers

- 2026 Pre-Season Testing Confirms a Two-Tier Grid as Energy Management Defines Formula 1's New Era

- The Tree That Grew Slowly - Now Available!

- Platinum Car Audio LLC Focuses on Customer-Driven Vehicle Audio and Electronics Solutions

- Postmortem Pathology Expands Independent Autopsy Services in Kansas City

- Postmortem Pathology Expands Independent Autopsy Services Across Colorado

- $38 Million in U.S. Government Contract Awards Secured Through Strategic Partner. Establishing Multi-Year Defense Revenue Platform Through 2032: $BLIS

- Mecpow M1: A Safe & Affordable Laser Engraver Built for Home DIY Beginners

- CrashStory.com Launches First Colorado Crash Data Platform Built for Victims, Not Lawyers

- Digi 995: Awakening of the Last Machine Expands Global Availability Across Major Retail Platforms

- Inkdnylon Earns BBB Accreditation for Verified Business Integrity

- Josh Stout "The Western Project"

- Open House Momentum Builds at Heritage at South Brunswick

- A Celebration of Visibility, Voice and Excellence: The 57th NAACP Image Awards Golf Invitational, Presented by Wells Fargo, A PGD Global Production

- Athens in Spring: A Culinary City Break That Rivals Paris and Copenhagen

- Front Porch Wisdom Wins "2026 Outstanding Book Of The Year" By The Illumination Book Awards

- ClearSight Therapeutics Signs LOI with Covalent Medical for $60M Multi-Channel OTC Eye Care Partnership